For the 24 hours to 23:00 GMT, the USD declined 0.5% against the JPY and closed at 100.32. The Japanese Yen gained ground, despite the Bank of Japan (BoJ) Governor, Haruhiko Kuroda, commenting that the central bank would do everything necessary to get inflation back on the rise, including cutting interest rates further into negative territory.

In other economic news, Japan’s final leading economic index rose to a level of 100.0 in July, confirming the preliminary print. Additionally, the nation’s final coincident index fell to a level of 112.1 in July, following a level of 112.8 recorded in the preliminary print.

In the Asian session, at GMT0300, the pair is trading at 100.63, with the USD trading 0.31% higher against the JPY from yesterday’s close.

Minutes of the BoJ’s latest monetary policy meeting revealed that policymakers remain optimistic about the nation’s economic growth recovery and also believed that inflation would likely accelerate towards the 2.0% target in fiscal year 2017. However, it also indicated that board members fretted over weak inflation expectations and uncertain prospects for achieving its price goal, that could call for further monetary policy accommodation.

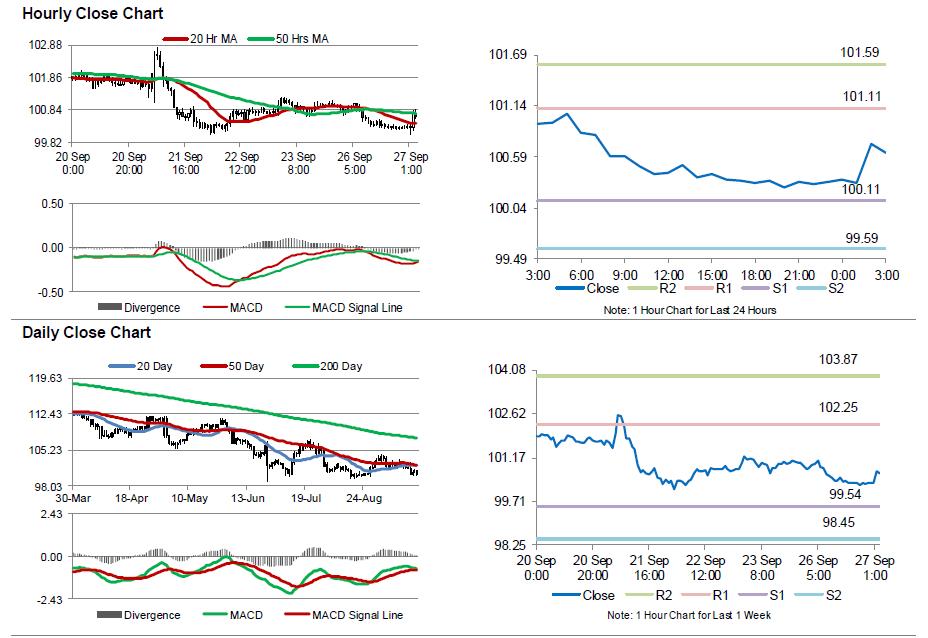

The pair is expected to find support at 100.11, and a fall through could take it to the next support level of 99.59. The pair is expected to find its first resistance at 101.11, and a rise through could take it to the next resistance level of 101.59.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.