For the 24 hours to 23:00 GMT, the USD declined 0.31% against the JPY and closed at 109.72.

In economic news, Japan’s consumer confidence index eased to a 3-year low level of 40.4 in April and less than market expectations for a fall to a level of 40.3. The index had recorded a level of 40.5 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 109.86, with the USD trading 0.13% higher against the JPY from yesterday’s close.

The Bank of Japan’s summary of April monetary policy meeting revealed that there continues to be risk that Japan may slide into recession depending on sales tax hike impact, overseas developments. Additionally, the bank stated that uncertainty on price outlook would persist through fiscal 2021.

Data showed that Japan’s household spending rose 2.1% on a yearly basis in March, more than market expectations. Household spending had recorded a rise of 1.7% in the previous month.

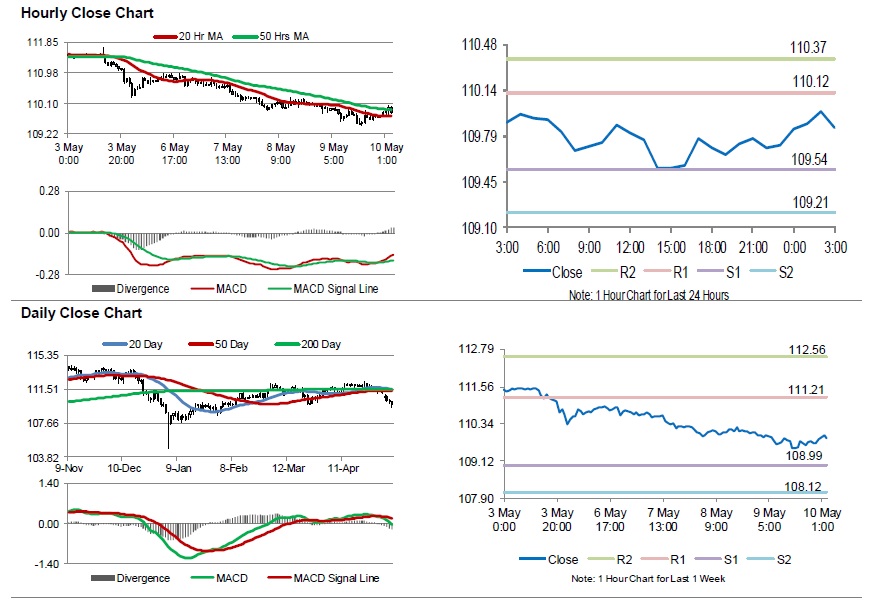

The pair is expected to find support at 109.54, and a fall through could take it to the next support level of 109.21. The pair is expected to find its first resistance at 110.12, and a rise through could take it to the next resistance level of 110.37.

Moving ahead, investors would keep an eye on Japan’s trade balance data and machine tool orders, set to release next week.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.