For the 24 hours to 23:00 GMT, the USD slightly rose against the JPY and closed at 111.21.

In the Asian session, at GMT0400, the pair is trading at 111.46, with the USD trading 0.22% higher against the JPY from yesterday’s close.

Overnight data indicated that Japan’s preliminary Nikkei manufacturing PMI jumped to a level of 53.8 in November, expanding at its fastest pace in more than three years, underscoring optimism over the state of the nation’s manufacturing sector.

Earlier in the session, data showed that the nation’s final leading economic index fell to a level of 106.4 in September, higher than a drop to a level of 106.6 indicated in the preliminary figures. The index had recorded a reading of 107.2 in the previous month. Also, the nation’s final coincident index eased less than initially estimated to a level of 116.2 in September, compared to a flash print indicating a fall to a level of 115.8. The index had registered a level of 117.7 in the previous month.

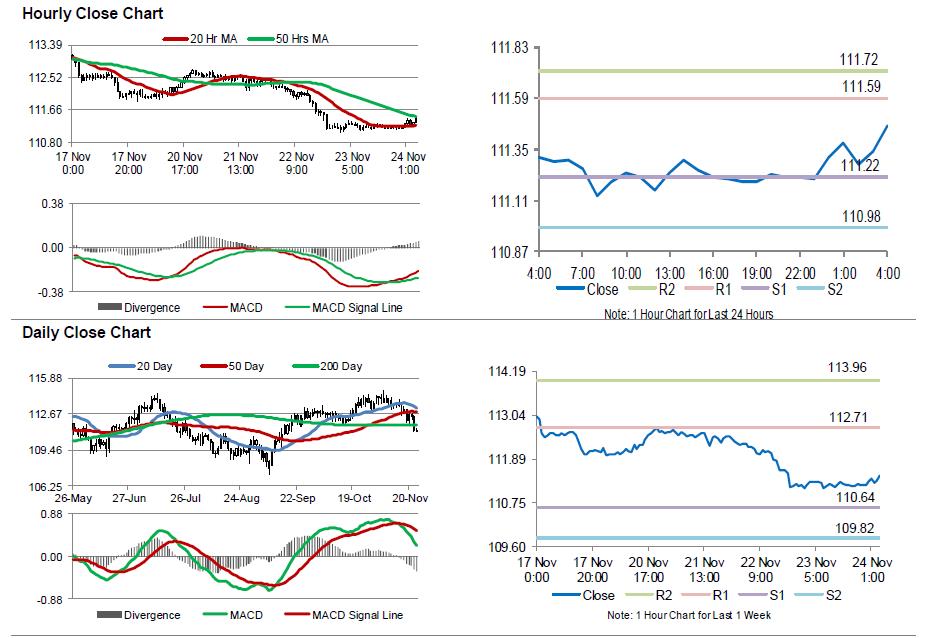

The pair is expected to find support at 111.22, and a fall through could take it to the next support level of 110.98. The pair is expected to find its first resistance at 111.59, and a rise through could take it to the next resistance level of 111.72.

Looking forward, investors would focus on Japan’s jobless rate, the national consumer price index and industrial production data, all scheduled for release in the next week.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.