For the 24 hours to 23:00 GMT, the USD declined 2.32% against the JPY and closed at 107.60.

In the Asian session, at GMT0300, the pair is trading at 107.59, with the USD trading marginally lower against the JPY from yesterday’s close.

Overnight data showed that Japan’s national consumer price inflation slowed to 0.1% on a yearly basis in April, compared to a level of 0.4% in the previous month.

The Bank of Japan (BoJ), in its interest rate decision, kept its key interest rate unchanged at -0.1%, as widely expected. Moreover, the central bank launched a “Main Street” lending program to support small business, with an estimated package worth ¥30 trillion.

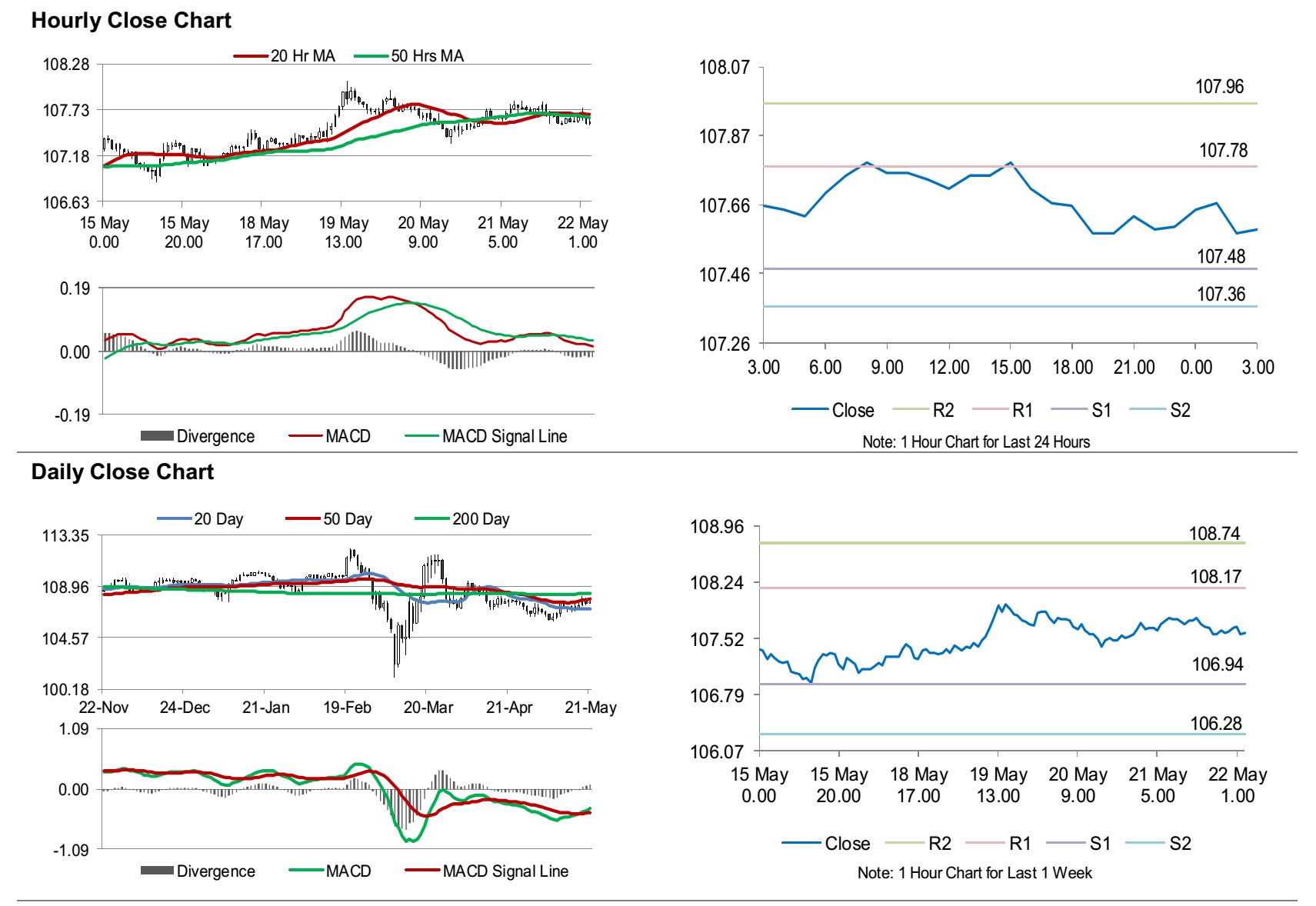

The pair is expected to find support at 107.48, and a fall through could take it to the next support level of 107.36. The pair is expected to find its first resistance at 107.78, and a rise through could take it to the next resistance level of 107.96.

With no macroeconomic releases in Japan today, investor sentiment would be governed by global macroeconomic events.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.