For the 24 hours to 23:00 GMT, USD rose 0.40% against the CAD to close at 0.9897.

Canadian dollar declined against the greenback amid decline in the oil and metal prices, raising speculation that the global economic slowdown would hamper the demand for raw materials.

In the US, the Producer Price Index (PPI), on annual basis, rose 6.5% in August following 7.2% growth in the previous month. Additionally, on a monthly basis, business inventories climbed 0.4% in July, following an upwardly revised 0.4% rise recorded in the previous month.

In Canada, the capacity utilization declined to 78.4% in the second quarter of 2011, compared to a revised rate of 78.9% recorded in first quarter of 2011.

In the Asian session at 3:00GMT, USD is trading at 0.9913, 0.16% higher against the Canadian dollar from yesterday’s close at 23:00 GMT.

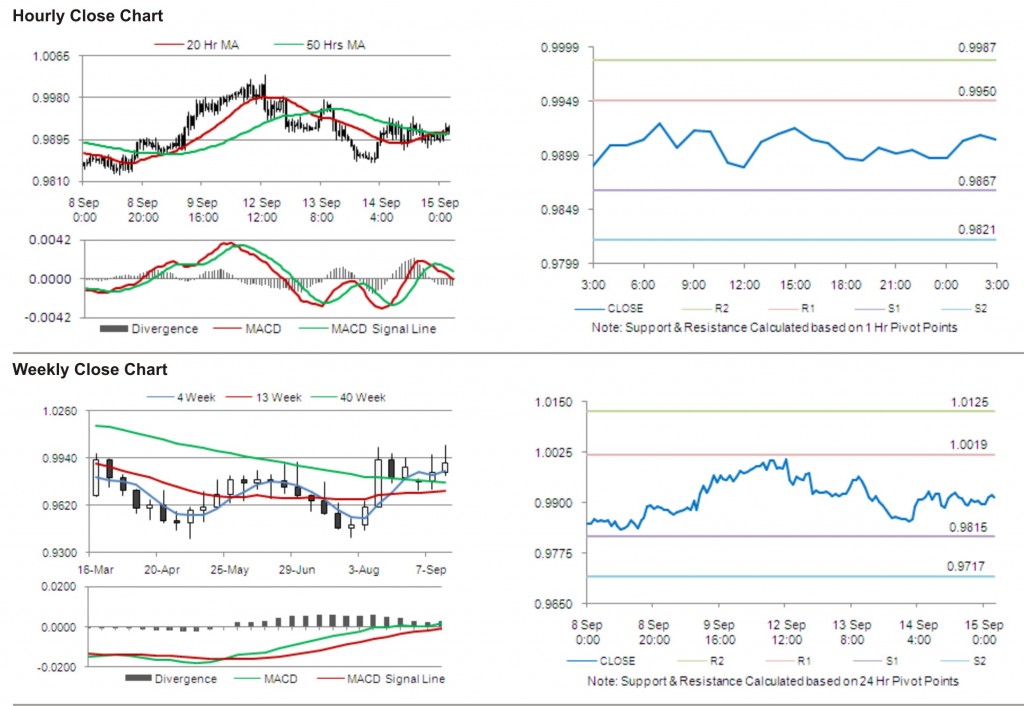

The first area of short term resistance is observed at 0.9950, followed by 0.9987 and 1.0070. The first area of support is at 0.9867, with the subsequent supports at 0.9821 and 0.9738.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.