For the 24 hours to 23:00 GMT, EUR rose 0.88% against the USD and closed at 1.3872, after the European Central Bank stated that it would take steps to provide liquidity for the region’s struggling banks.

The European Central Bank (ECB) in its monthly bulletin indicated that inflation risks in the Euro-zone have eased but added that downside risks have intensified.

In the economic news in the Euro zone, on an annual basis, the Consumer Price Inflation (CPI) stood at 2.5% in August, unchanged from the previous month. The employment rose 0.3% in the second quarter of 2011, following a 0.1% growth recorded in the first quarter of 2011.

In the Asian session, at 3:00GMT, the EUR is trading at 1.3857, 0.11% lower against USD, from the levels yesterday at 23:00GMT.

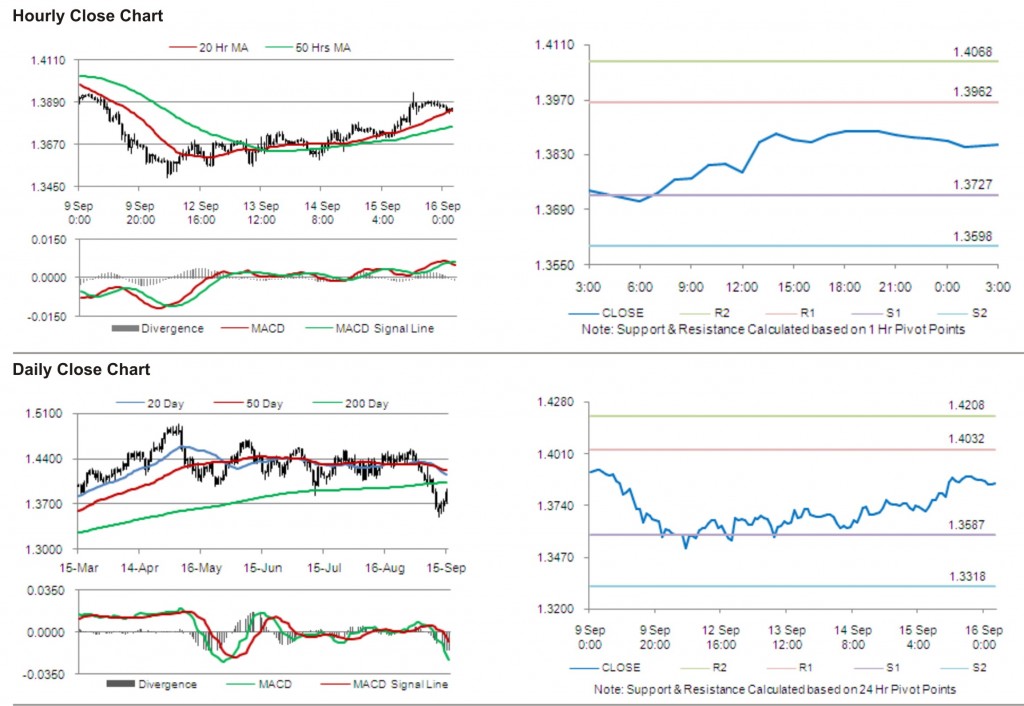

The pair has its first short term resistance at 1.3962, followed by the next resistance at 1.4068. The first support is at 1.3727, with the subsequent support at 1.3598.

Trading trends in the pair today are expected to be determined by release of trade balance and current account data in the Euro zone.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.