For the 24 hours to 23:00 GMT, AUD weakened 0.51% against the USD to close at 1.0263, as investor sentiment dented over more disappointing attempts by European policymakers to solve their deteriorating sovereign debt crisis.

This morning, the minutes of the Reserve Bank of Australia’s September 6 board meeting showed the bank was still taking a wait-and-see approach as it monitored inflationary pressures and the deteriorating global economy.

In the Asian session at 3:00GMT, the Australian Dollar is trading at 1.0178, 0.83% lower from yesterday’s close at 23:00 GMT.

LME Copper prices declined 4.2% or $366.5/MT to $8,414.8/ MT. Aluminium prices declined 1.5% or $36.0/MT to $2,309.5/ MT.

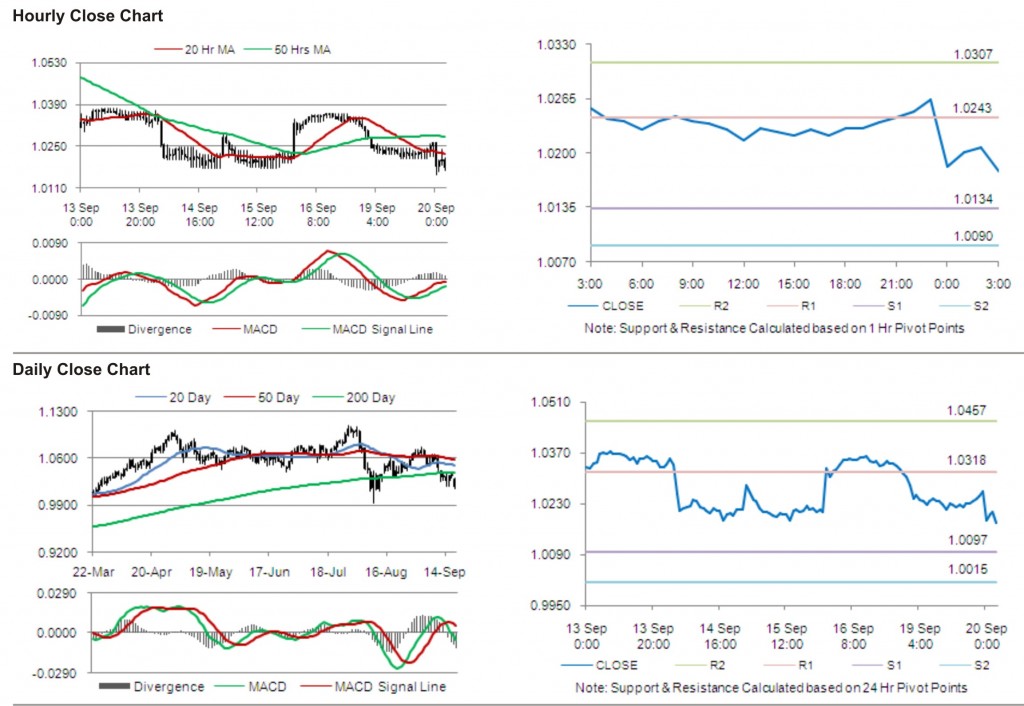

The pair is expected to find first short term resistance at 1.0243, with the next resistance levels at 1.0307 and 1.0416, subsequently. The first support for the pair is seen at 1.0134, followed by next supports at 1.0090 and 0.9982 respectively.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.