For the 24 hours to 23:00 GMT, EUR declined 0.71% against the USD and closed at 1.3584.

The greenback rallied against the Euro, even as the Federal Reserve announced that it would replace $400 billion of short-term debt in its portfolio with longer- term Treasuries, in a move known as “Operation Twist”. The Federal Reserve officials stated that there are significant downside risks to the economic outlook. Meanwhile, S&P lowered its ratings on several Italian banks.

In the Asian session, at 3:00GMT, the EUR is trading at 1.3538, 0.34% lower against USD, from the levels yesterday at 23:00GMT.

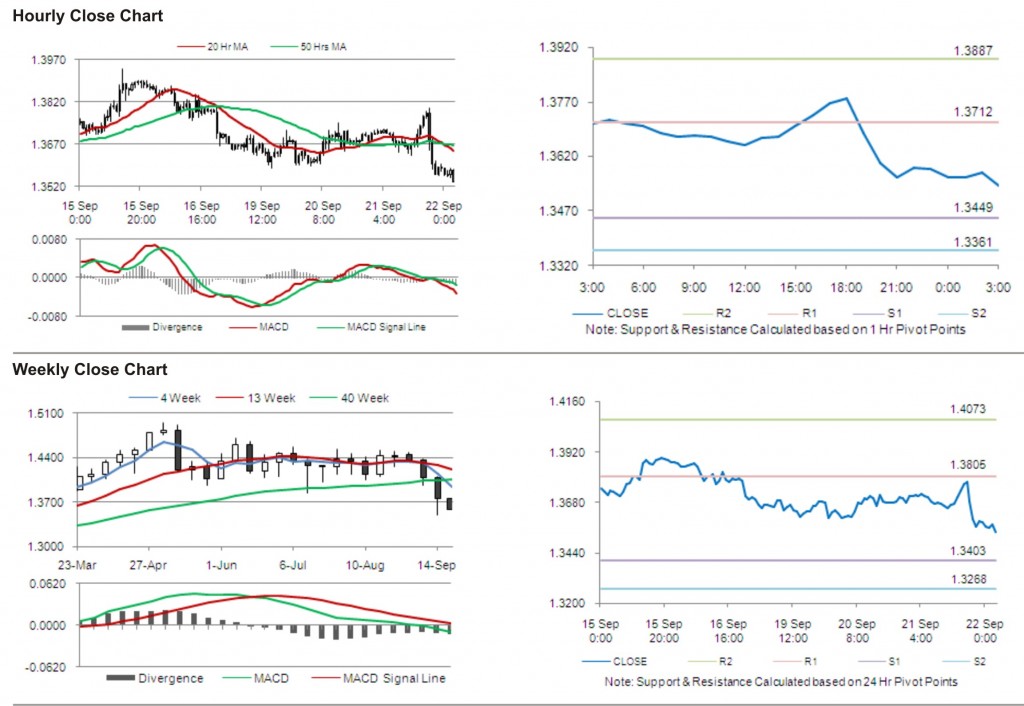

The pair has its first short term resistance at 1.3712, followed by the next resistance at 1.3887. The first support is at 1.3449, with the subsequent support at 1.3361.

With a series of Euro zone economic releases today, including consumer confidence and Purchasing Manager Index (PMI), trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.