For the 24 hours to 23:00 GMT, EUR declined 0.76% against the USD and closed at 1.3480, as poor economic data from China and the eurozone, coupled with renewed worries about the global economic slowdown, spurred investors to sell riskier assets.

In economic news, in the Euro zone, the manufacturing Purchasing Manager’s Index (PMI) declined to 48.4 in September, compared to 49.0 in August. The services Purchasing Manager’s Index (PMI) declined to 49.1 in September, from 51.5 in August. The industrial new orders declined 2.1% (M-o-M) in July, following a 1.2% drop in June. The consumer confidence index declined to -18.9 in September, from -16.5 in the previous month.

Additionally, in Germany, on a seasonally adjusted basis, the manufacturing PMI dropped to a reading of 50.0 in September, following a reading of 50.9 posted in August. The services PMI fell to a reading of 50.3 in September, following a reading of 51.1 posted in August.

In the Asian session, at 3:00GMT, the EUR is trading at 1.3533, 0.39% higher against USD, from the levels yesterday at 23:00GMT, after Japanese news agency reported that G20 Finance Ministers and Central Bankers would confirm their intent to cooperate internationally to prevent a worsening of the eurozone’s debt crisis and are working on an emergency statement.

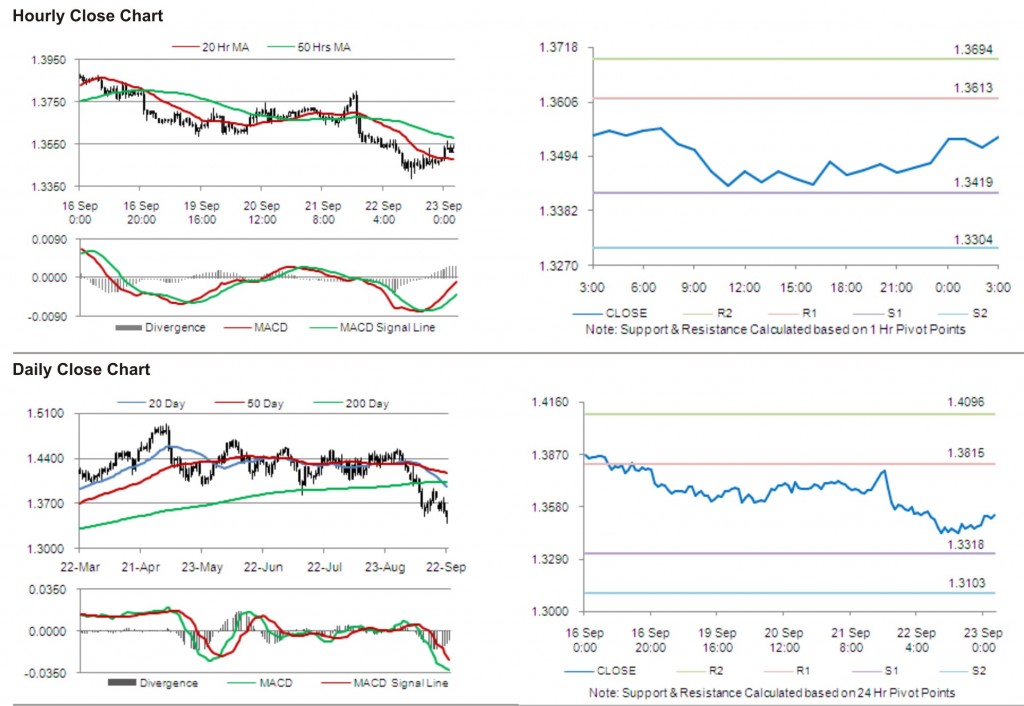

The pair has its first short term resistance at 1.3613, followed by the next resistance at 1.3694. The first support is at 1.3419, with the subsequent support at 1.3304.

Investors are the eying European Central Bank President Trichet’s speech along with other economic data in the Euro zone to be released later today.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.