For the 24 hours to 23:00 GMT, EUR declined marginally against the USD and closed at 1.3518.

EUR pared its losses amid speculation that the European Central Bank (ECB) may cut interest rates to support the eurozone’s economy, after ECB Governing Council Member, Ewald Nowotny stated that the possibility of interest rate cuts should not be ruled out.

In German economic news, the IFO Business Climate Index declined to 107.5 in September, from 108.7 registered the previous month. The Current Assessment Index declined to 117.9 in September, following 118.1 in August. Additionally, the IFO Expectations Index decreased to 98.0 in September, from 100.1 in August.

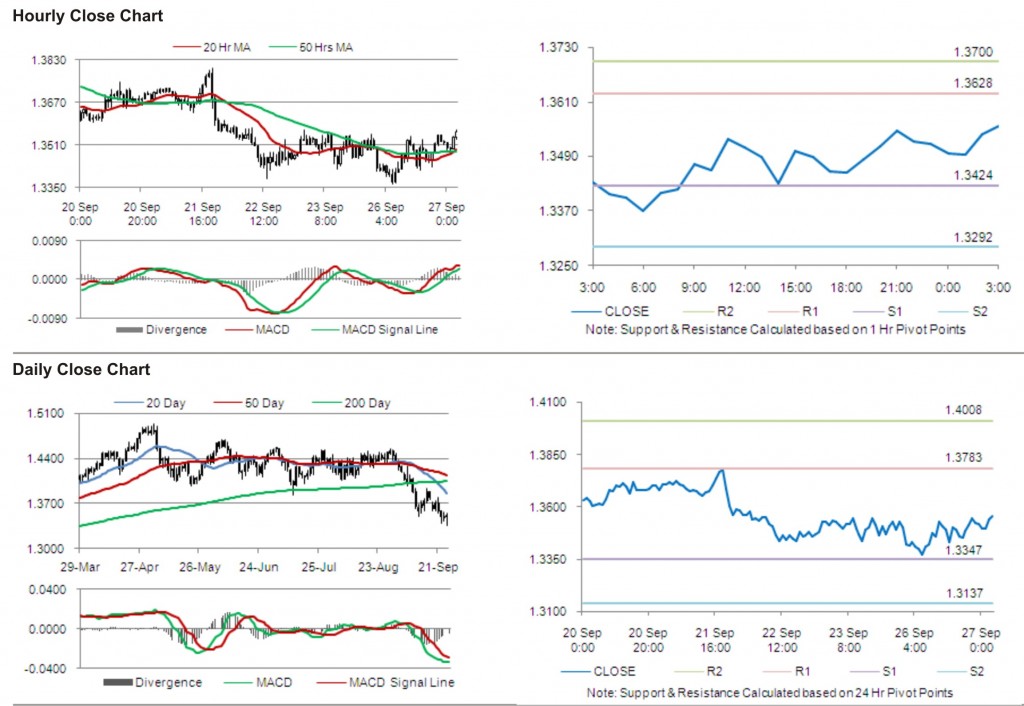

In the Asian session, at 3:00GMT, the EUR is trading at 1.3557, 0.29% higher against USD, from the levels yesterday at 23:00GMT.

The pair has its first short term resistance at 1.3628, followed by the next resistance at 1.3700. The first support is at 1.3424, with the subsequent support at 1.3292.

Trading trends in the pair today are expected to be determined by release of money supply data in the Euro zone.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.