For the 24 hours to 23:00 GMT, EUR rose 1.00% against the USD and closed at 1.3325, after Federal Reserve Chairman, Ben Bernanke stated that Fed might take more action to help revive the US economy. Euro also gained, after a report showed that the Euro zone officials are discussing coordinated action to recapitalize the continent’s banks.

Moody’s Investors Service downgraded Italy’s credit rating to A2 from Aa2, over concern that Prime Minister Silvio Berlusconi’s government would struggle to reduce the region’s second-largest debt amid chronically weak growth.

In economic news, on a monthly basis, the producer price index (PPI) in the Euro-zone declined 0.1% in August, following a 0.5% increase recorded in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.3290, with the EUR trading 0.26% lower from the New York close.

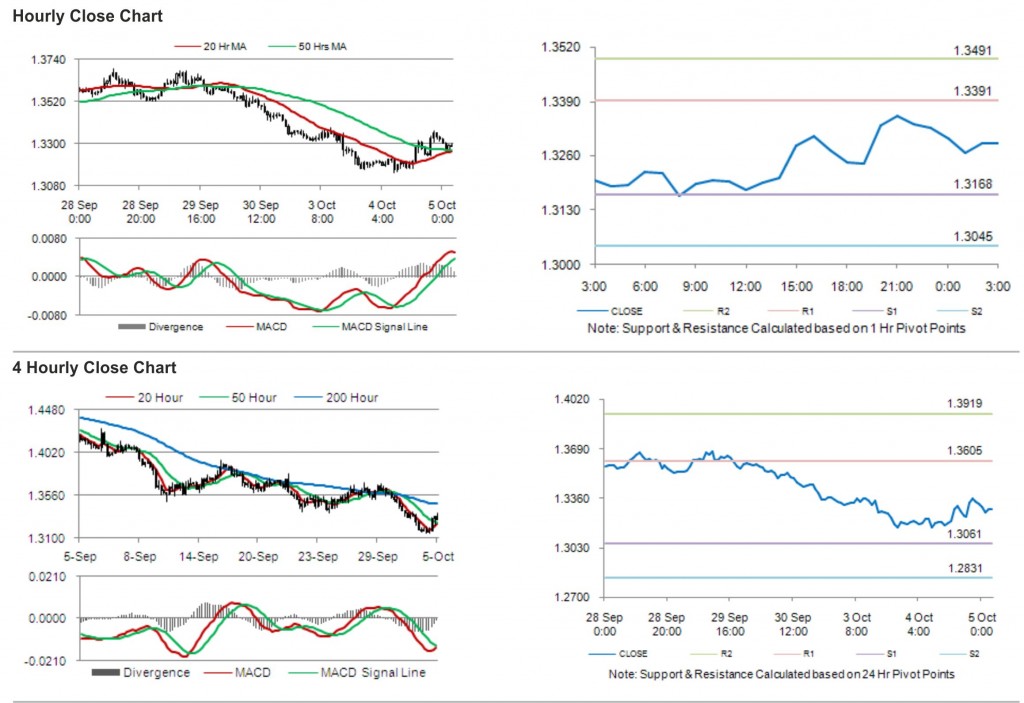

The pair is expected to find support at 1.3168, and a fall through could take it to the next support level of 1.3045. The pair is expected to find its first resistance at 1.3391, and a rise through could take it to the next resistance level of 1.3491.

With a series of Euro zone economic releases today, including Purchasing Managers’ Index (PMI) and retail sales, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.