Oil prices advanced 2.02% against the USD for the 24 hour period ending 23:00GMT, closing at 77.96 after API report showed a decline in the crude oil inventories.

Crude oil prices also gained, following the Federal Reserve Chairman, Ben S. Bernanke’s statement that the central bank stands ready to take additional steps to boost the US economic growth.

Late Tuesday, the American Petroleum Institute reported that the crude oil supplies fell 3.1 million barrels for the week ended September 30. Gasoline inventories declined 5.0 million barrels, while distillate inventories also fell 2.0 million barrels.

In the Asian session, at GMT0300, Crude oil is trading at 77.6, 0.46% lower from the New York close.

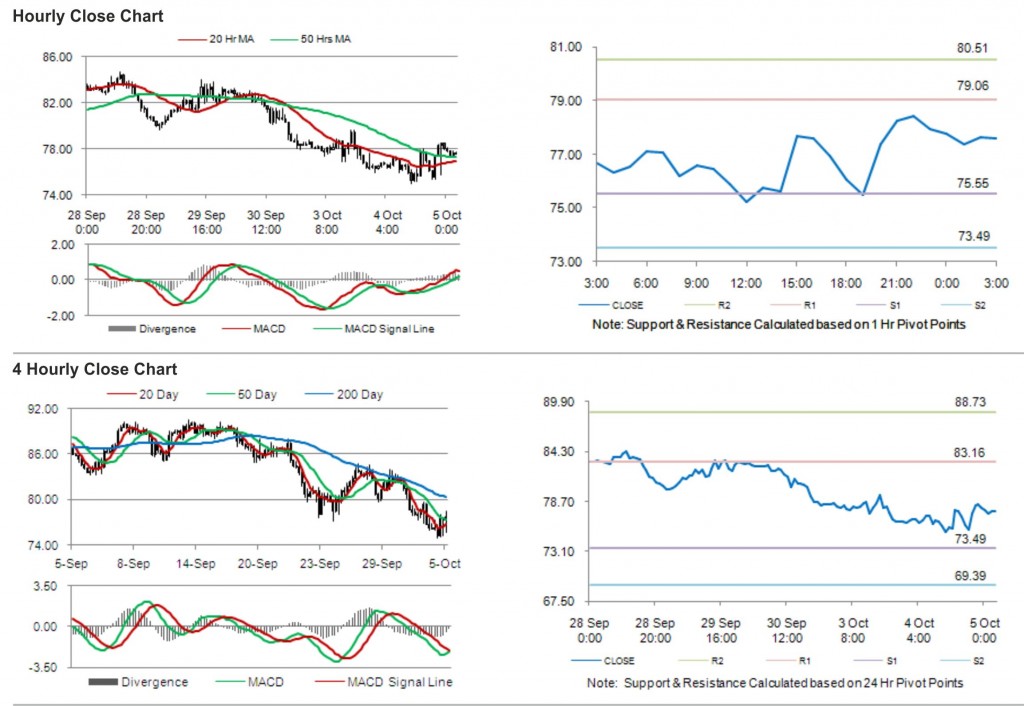

Crude oil is expected to find support at 75.55, and a fall through could take it to the next support level of 73.49. Crude oil is expected to find its first resistance at 79.06, and a rise through could take it to the next resistance level of 80.51.

Crude oil is trading just above its 20 Hr and 50 Hr moving averages.