For the 24 hours to 23:00 GMT, GBP fell 0.43% against the USD and closed at 1.5590, after UK manufacturing production declined 0.3% (M-o-M) in August, following a 0.1% rise in July.

Pound further declined after the British Chambers of Commerce stated that the expansion of the Bank of England’s (BoE) monetary stimulus program announced last week may not be enough to prevent another recession.

In other UK economic news, industrial production rose 0.2% (M-o-M) in August, following a 0.4% decline in July. On an annual basis, the DCLG House Price Index fell 1.3% in August, following a 1.5% decline in July. The National Institute of Economic and Social Research reported that the Gross Domestic Product (GDP) grew 0.5% in the 3 months to September.

In the Asian session, at GMT0300, the pair is trading at 1.5559, with the GBP trading 0.20% lower from the yesterday’s close.

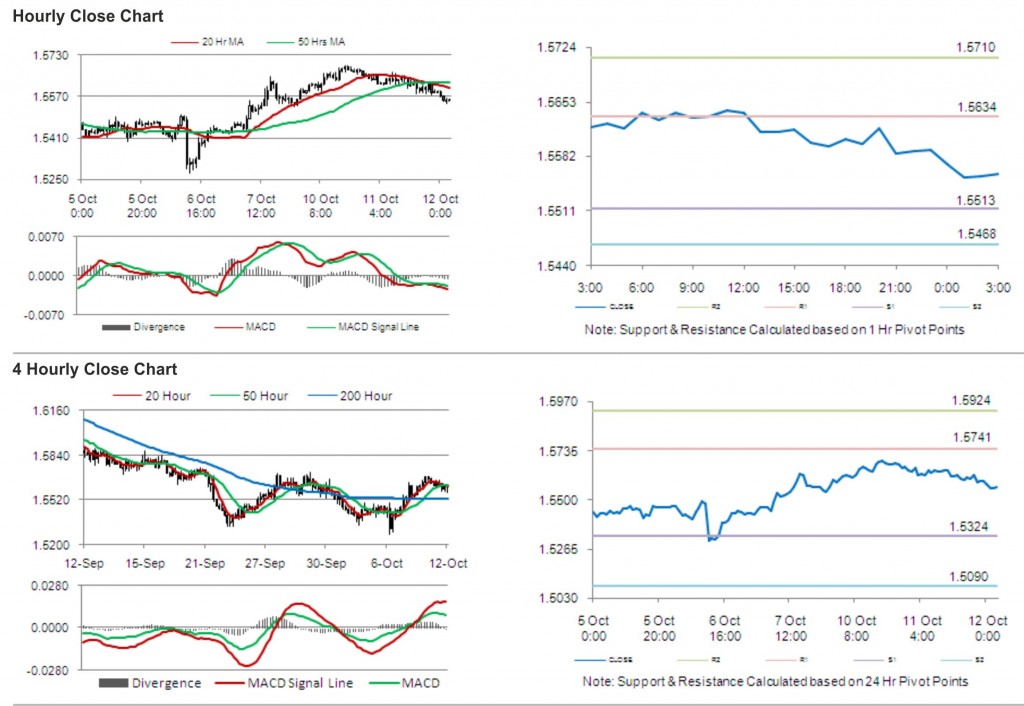

The pair is expected to find support at 1.5513, and a fall through could take it to the next support level of 1.5468. The pair is expected to find its first resistance at 1.5634, and a rise through could take it to the next resistance level of 1.5710.

With a series of UK economic releases today, including unemployment rate and claimant count rate, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.