For the 24 hours to 23:00 GMT, USD rose 0.50% against the CAD to close at 1.0229.

Canadian dollar fell against the greenback, as risk appetite declined for riskier assets, amid poor traded data from China.

Meanwhile, in Canada, the trade deficit widened to $622.0 million in August, compared to a deficit of $539.0 million in July.

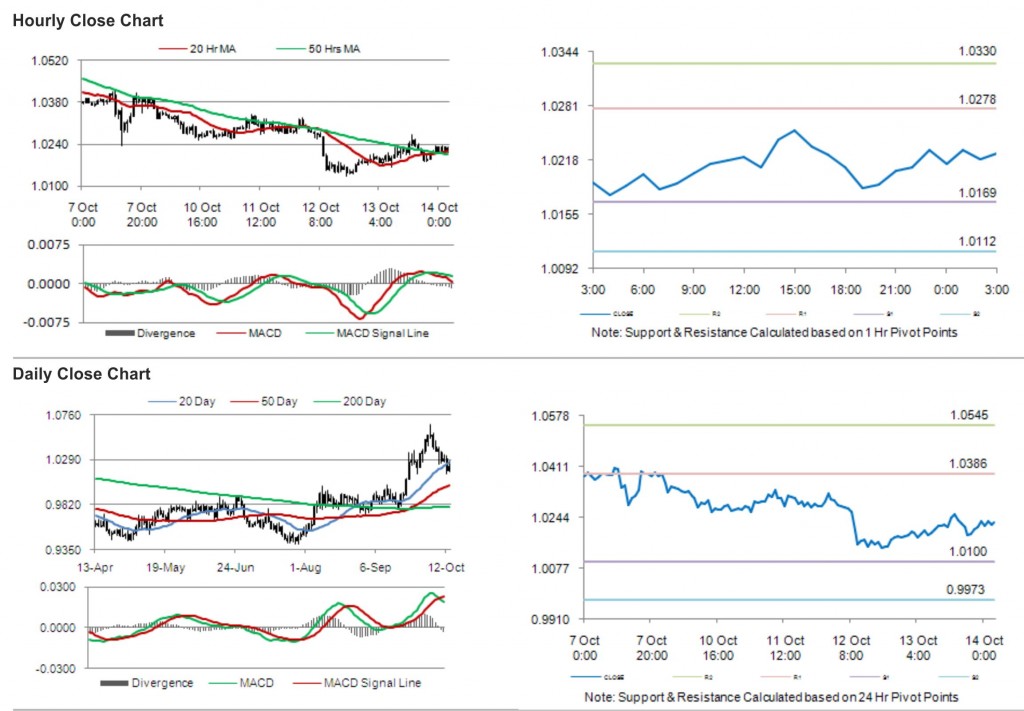

In the Asian session, at GMT0300, the pair is trading at 1.0226, with the pair trading slightly lower from yesterday’s close.

The pair is expected to find support at 1.0169, and a fall through could take it to the next support level of 1.0112. The pair is expected to find its first resistance at 1.0278, and a rise through could take it to the next resistance level of 1.0330.

The pair is expected to trade on the cues from the release of data on manufacturing shipments in Canada.

The currency pair is showing convergence with its 20 Hr and its 50 Hr moving averages.