For the 24 hours to 23:00 GMT, AUD weakened 1.54% against the USD to close at 1.0173

This morning, Australia’s central bank left open the possibility of a cut in interest rates as early as November. In the minutes of its October 4 policy meeting, the Reserve Bank of Australia (RBA) stated that the recent rise in unemployment and slowing economic growth revealed that inflation was likely running at a pace more in line with its target of 2%-3%.

In the Asian session, at GMT0300, the pair is trading at 1.0181, with the AUD trading 0.08% higher from yesterday’s close.

LME Copper prices rose 0.9% or $65.3/MT to $7,565.5/ MT. Aluminium prices rose 1.8% or $38.5/MT to $2,209.0/ MT.

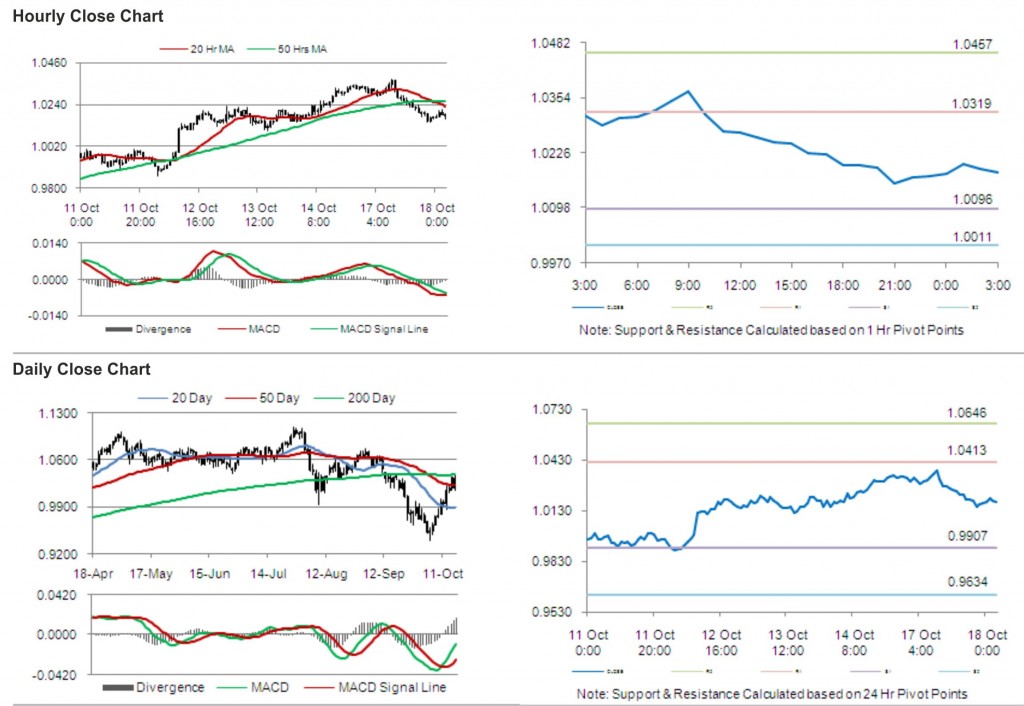

The pair is expected to find support at 1.0096, and a fall through could take it to the next support level of 1.0011. The pair is expected to find its first resistance at 1.0319, and a rise through could take it to the next resistance level of 1.0457.

The pair is expected to trade on the cues from the release of Westpac Leading Index in Australia.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.