For the 24 hours to 23:00 GMT, USD rose 0.34% against the CAD to close at 1.0186, as fresh concerns over Europe’s bailout fund saw investors sell higher-yielding currencies.

In Canada, the Composite Leading Index declined 0.1% (M-o-M) in September, unchanged from August.

In the Asian session, at GMT0300, the pair is trading at 1.0228, with the USD trading 0.41% higher from yesterday’s close.

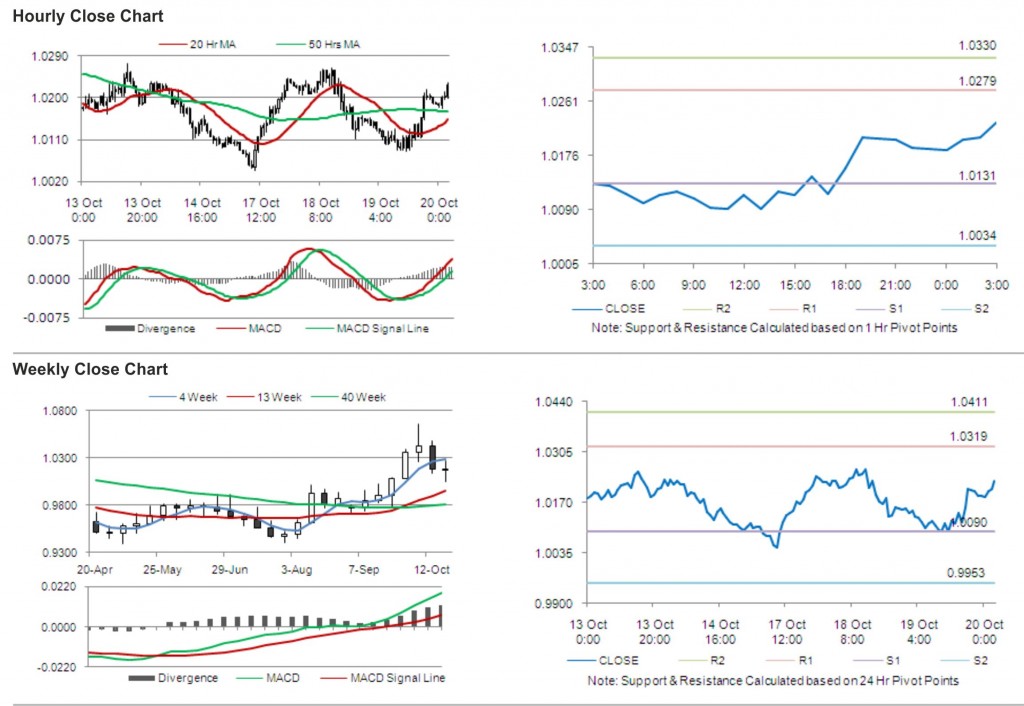

The pair is expected to find support at 1.0131, and a fall through could take it to the next support level of 1.0034. The pair is expected to find its first resistance at 1.0279, and a rise through could take it to the next resistance level of 1.0330.

The pair is expected to trade on the cues from the release of wholesale sales data in Canada.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.