For the 24 hours to 23:00 GMT, GBP rose marginally against the USD and closed at 1.6000.

In the UK, the British Bankers’ Association (BBA) indicated that the number of mortgage approvals unexpectedly dropped to 33,130 in September, from 35,069 in August. Also, the current account deficit narrowed to £2.0 billion in 2Q FY2011, from a downwardly revised deficit of £4.1 billion in the first quarter.

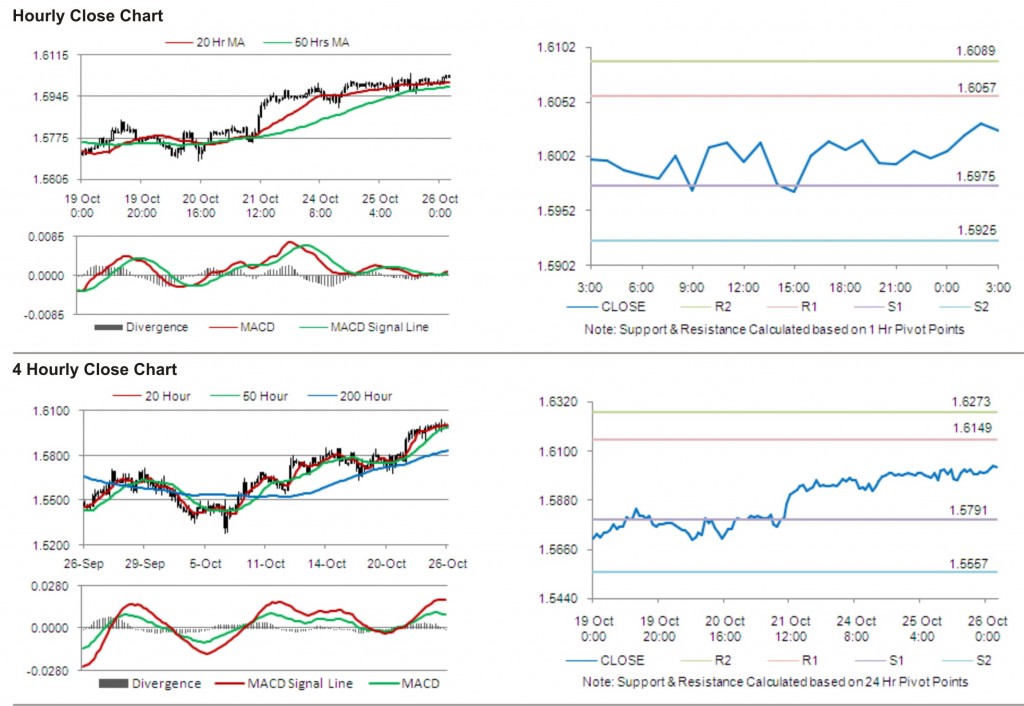

In the Asian session, at GMT0300, the pair is trading at 1.6025, with the GBP trading 0.16% higher from yesterday’s close.

The pair is expected to find support at 1.5975, and a fall through could take it to the next support level of 1.5925. The pair is expected to find its first resistance at 1.6057, and a rise through could take it to the next resistance level of 1.6089.

Trading trends in the pair today are expected to be determined by release of CBI industrial trends survey – orders data in the UK.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.