For the 24 hours to 23:00 GMT, GBP fell 0.28% against the USD and closed at 1.5956, amid concerns that the eurozone leaders would be unable to find a solution to the debt crisis.

In the UK, the Confederation of British Industry (CBI) in its quarterly industrial trends survey reported that the total order book balance fell to -18.0% (M-o-M) in October, compared to -9.0% recorded in the previous period.

In the Asian session, at GMT0300, the pair is trading at 1.6008, with the GBP trading 0.33% higher from yesterday’s close.

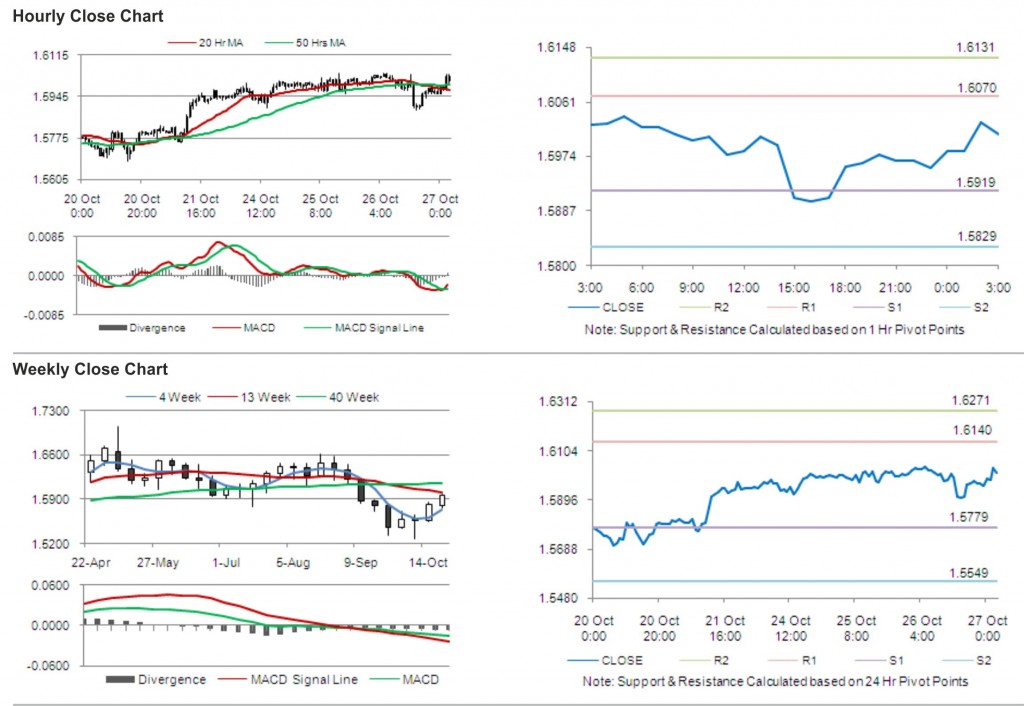

The pair is expected to find support at 1.5919, and a fall through could take it to the next support level of 1.5829. The pair is expected to find its first resistance at 1.6070, and a rise through could take it to the next resistance level of 1.6131.

Trading trends in the pair today are expected to be determined by release of data on CBI distributive trade survey and consumer confidence in the UK.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.