For the 24 hours to 23:00 GMT, EUR rose 2.24% against the USD and closed at 1.4178, amid announcement of a plan by the European leaders to contain the debt crisis. Eurozone leaders agreed on a deal to stem the debt crisis, including a 50% reduction in the value of Greek debt held by private investors and leveraging the bailout fund to around $1.4 trillion and recapitalizing European banks.

In economic news, the money supply growth in eurozone rose 3.1% (Y-o-Y) in September, compared to a 2.7% increase in August. The economic confidence index declined to 94.8 in October, compared to 95.0 in September. Additionally, the industrial confidence fell to -6.6 in October, compared to 5.9 in September, while consumer sentiment index declined to -19.9 in October from -19.1 last month.

In Germany, the Consumer Price Index (CPI) rose 2.5% (Y-o-Y) in October following 2.6% rise in the previous month.

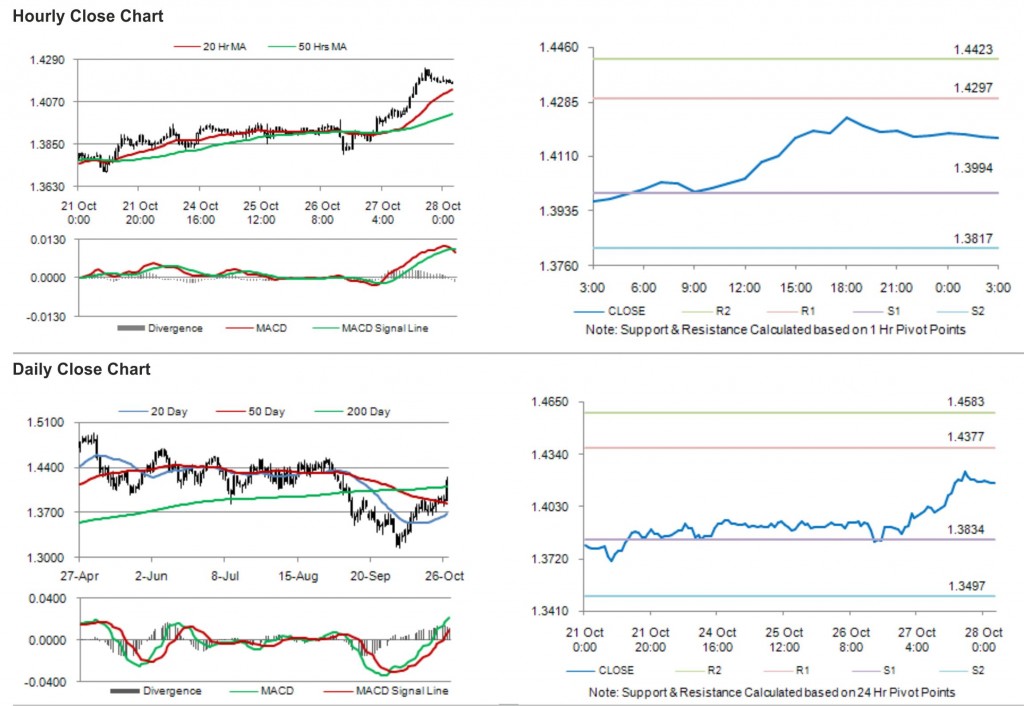

In the Asian session, at GMT0300, the pair is trading at 1.4170, with the EUR trading 0.06% lower from yesterday’s close.

The pair is expected to find support at 1.3994, and a fall through could take it to the next support level of 1.3817. The pair is expected to find its first resistance at 1.4297, and a rise through could take it to the next resistance level of 1.4423.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.