For the 24 hours to 23:00 GMT, USD declined 1.29% against the CAD to close at 0.9917, as European leaders plan to contain the debt crisis, raised appeal for high-yielding assets. A surge in crude oil prices further added to the gains.

In the US, the initial jobless claims fell to 402,000, compared to the previous week’s revised figure of 404,000, for the week ended 22 October 2011. Additionally, for the week ended 15 October 2011, continuing claims in the US fell to 3.645 million, compared to the preceding week’s upwardly revised level of 3.741 million.

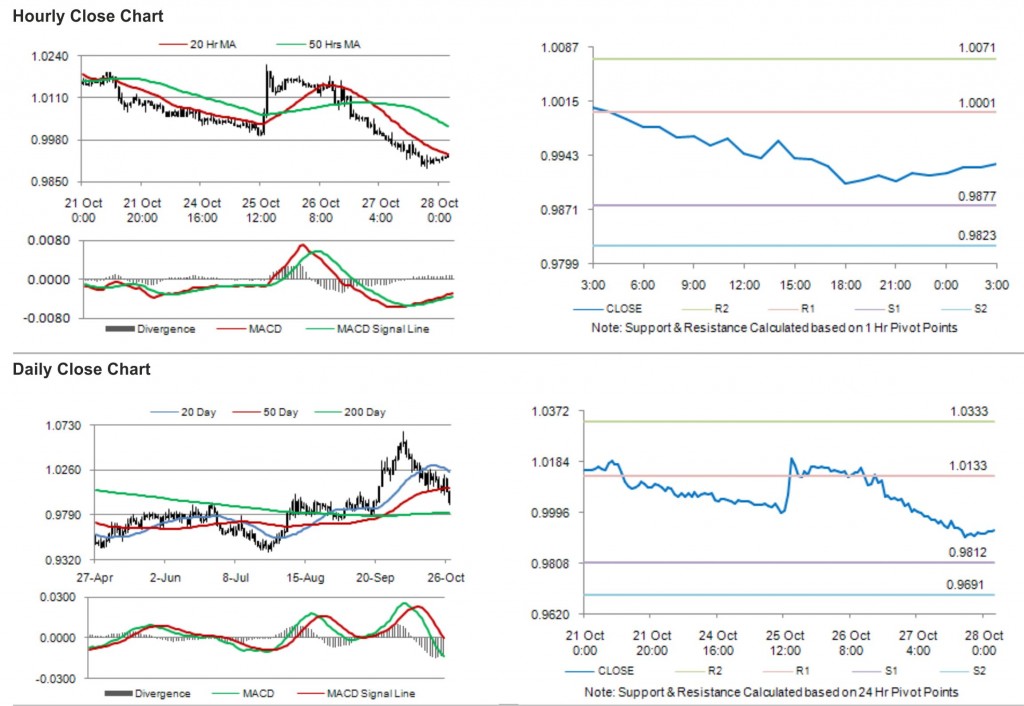

In the Asian session, at GMT0300, the pair is trading at 0.9932, with the USD trading 0.15% higher from yesterday’s close.

The pair is expected to find support at 0.9877, and a fall through could take it to the next support level of 0.9823. The pair is expected to find its first resistance at 1.0001, and a rise through could take it to the next resistance level of 1.0071.

The currency pair is showing convergence with its 20 Hr moving average and is trading well below its 50 Hr moving average.