For the 24 hours to 23:00 GMT, GBP fell 0.05% against the USD and closed at 1.6260.

Fed Chairman Ben Bernanke asserted that US recovery is not established until there is sustained jobs growth.

In the UK, M4 money supply rose by 2.1% (Y-o-Y) in January, following a 2.3% growth posted in December. Additionally, nationwide house prices index rose by 0.3% (M-o-M) in February compared to 0.1% decline in the previous month.

The pair opened the Asian session at 1.626, and is trading at 1.6238 at 4.00GMT. The pair is trading 0.14% lower from the New York session close.

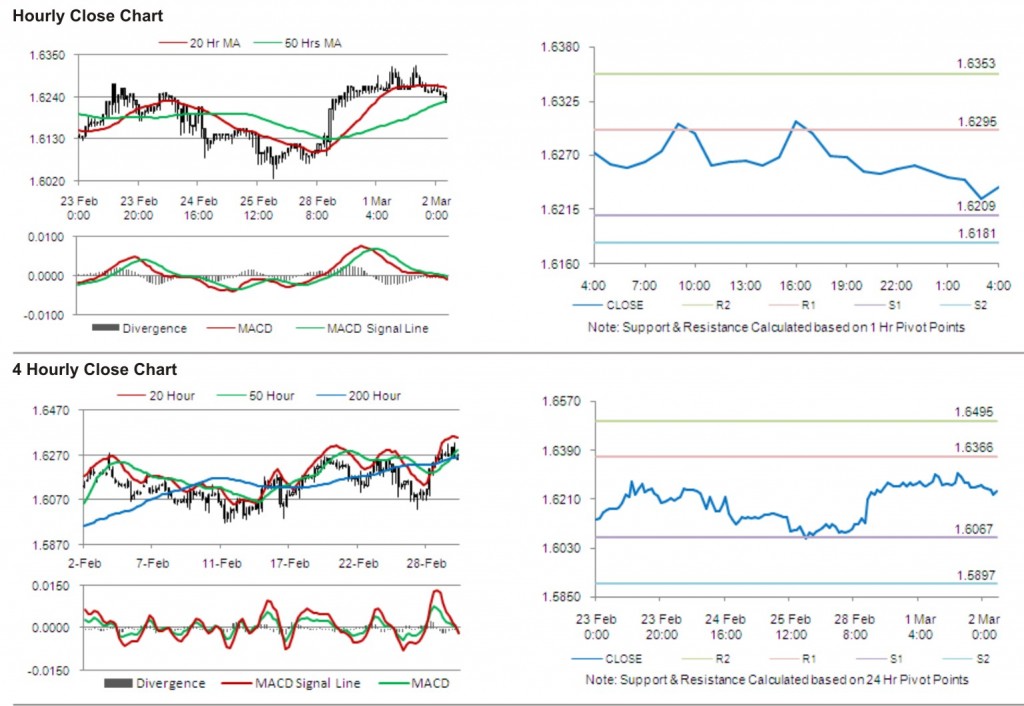

The pair has its first short term resistance at 1.6295, followed by the next resistance at 1.6353. The first support is at 1.6209, with the subsequent support at 1.6181.

With a series of UK economic releases today, including halifax house prices and PMI construction, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is showing convergence with its 50 Hr moving average and is trading below its 20 Hr moving average.