For the 24 hours to 23:00 GMT, GBP fell 0.84% against the USD and closed at 1.5927, following reports showing a decline in UK manufacturing data.

The manufacturing Purchasing Managers’ Index in the UK declined to 47.4 in October compared to 50.8 in the previous month. Market had expected the PMI to show a reading of 50.0 in October. Meanwhile, on a quarter-on-quarter basis, the Gross Domestic Product in the UK rose 0.5% in the third quarter of 2011 (3Q FY2011), compared to a 0.1% growth recorded in 2Q FY2011. The Index of Services increased 0.4% for the three months ended August, compared to 1.3% rise in the three months ended July. Additionally, the House Price Index rose 0.4% (M-o-M) in October, following 0.1% growth in the previous month.

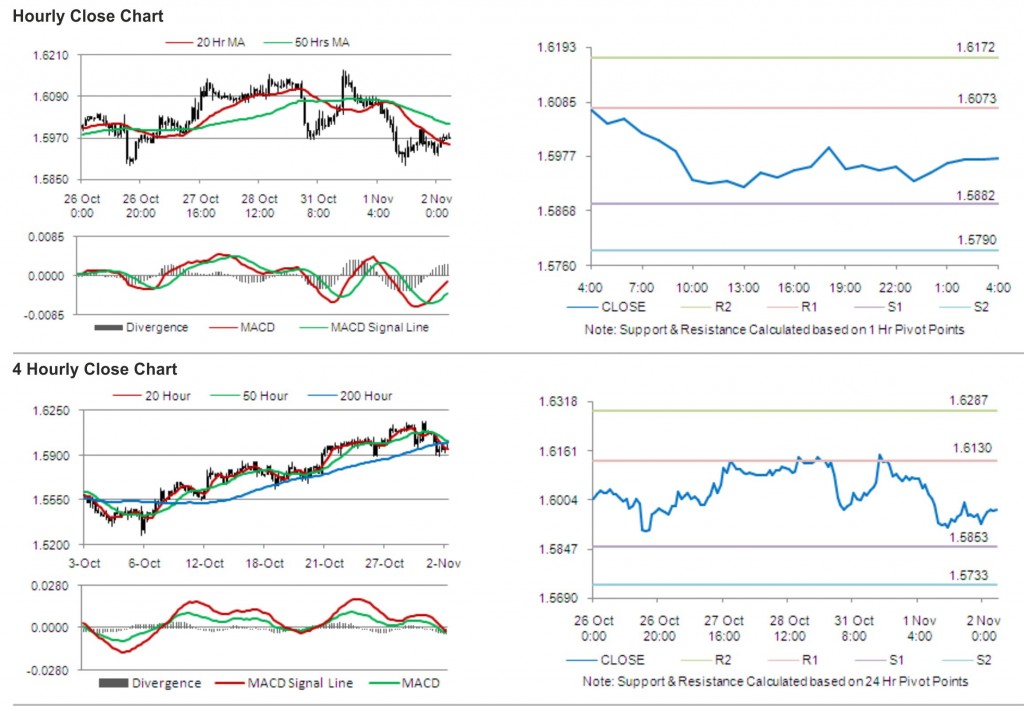

In the Asian session, at GMT0400, the pair is trading at 1.5973, with the GBP trading 0.29% higher from yesterday’s close.

The pair is expected to find support at 1.5882, and a fall through could take it to the next support level of 1.5790. The pair is expected to find its first resistance at 1.6073, and a rise through could take it to the next resistance level of 1.6172.

Trading trends in the pair today are expected to be determined by release of Halifax house price data and construction Purchasing Managers’ index (PMI) in the UK.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.