For the 24 hours to 23:00 GMT, USD strengthened 0.11% against the JPY and closed at 78.39.

In the US, the construction spending rose 0.2% (Y-o-Y) to $787.2 billion in September, compared to a revised level of $786.0 billion in August.

Additionally, in Japan, this morning, the monetary base rose 17.0% (Y-o-Y) in October, compared to 16.7% rise in the previous month.

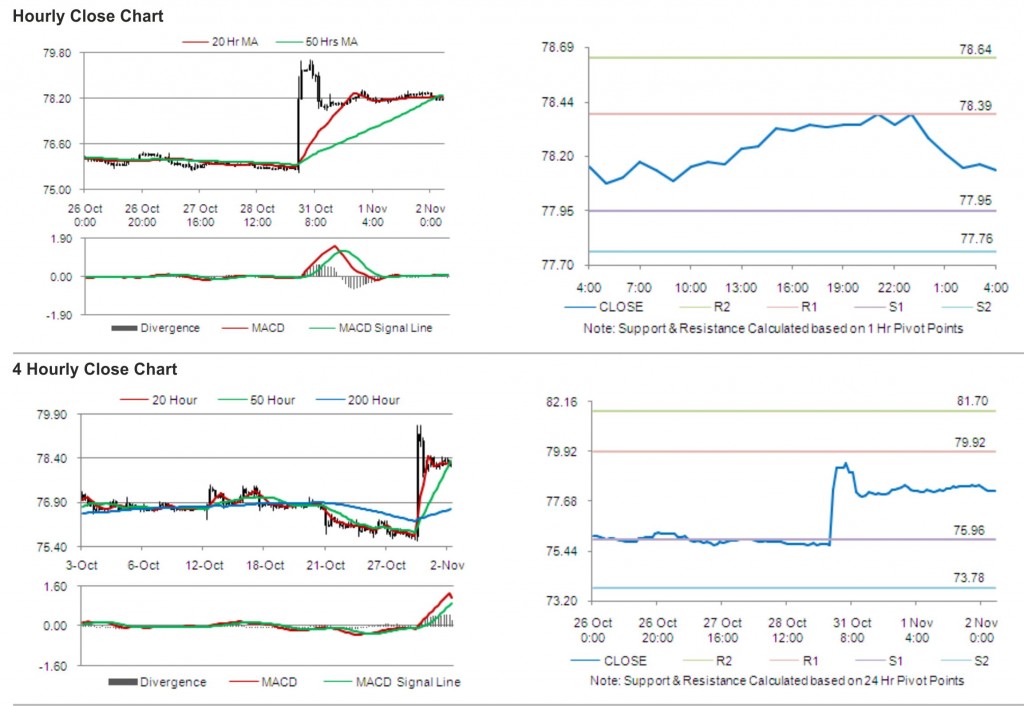

In the Asian session, at GMT0400, the pair is trading at 78.13, with the USD trading 0.33% lower from yesterday’s close. The Japanese Yen advanced as renewed speculation that Europe’s debt crisis is worsening, boosted appetite for safer assets.

The pair is expected to find support at 77.95, and a fall through could take it to the next support level of 77.76. The pair is expected to find its first resistance at 78.39, and a rise through could take it to the next resistance level of 78.64.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.