For the 24 hours to 23:00 GMT, EUR declined 0.31% against the USD and closed at 1.3764, on investor concerns that Italy was next in the line of fire in the European sovereign debt crisis.

Meanwhile, Greece continued to struggle to appoint a new prime minister and government, as global pressure mounted for a deal and a feared default loomed within weeks.

In the Euro-zone, the retail sales declined 0.7% (M-o-M) in September, compared to 0.1% rise recorded in August. The Sentix Investor Confidence Index declined to -21.2 in November, compared to -18.5 in the previous month.

Additionally, in Germany, on a monthly basis, industrial production declined 2.7% in September, compared to 0.4% decline in the previous month.

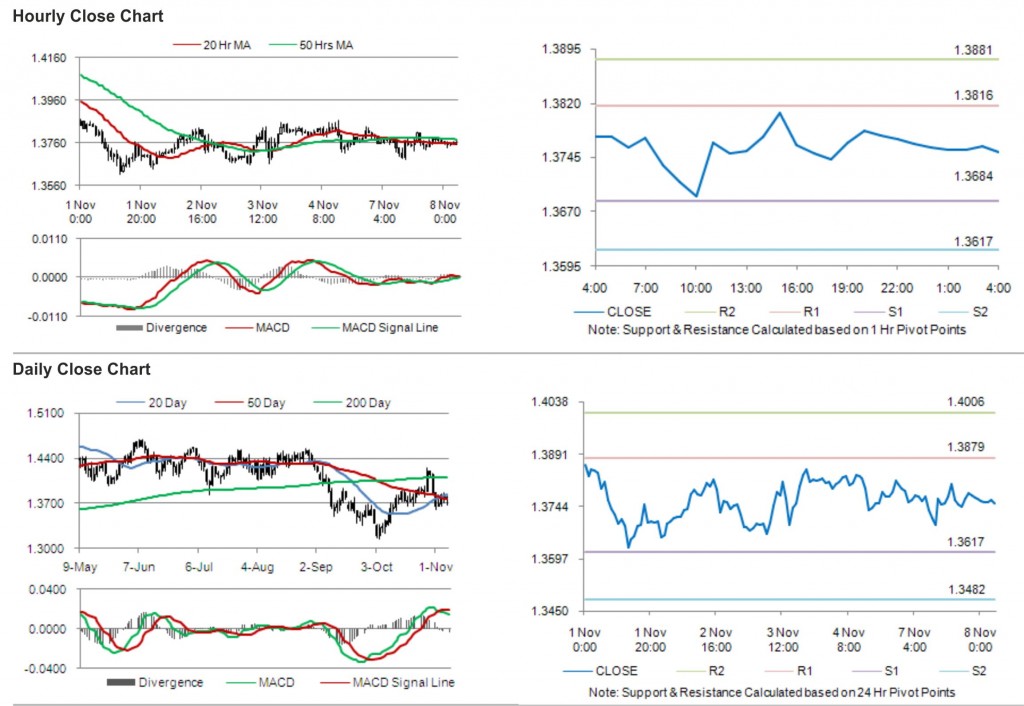

In the Asian session, at GMT0400, the pair is trading at 1.3752, with the EUR trading 0.09% lower from yesterday’s close.

The pair is expected to find support at 1.3684, and a fall through could take it to the next support level of 1.3617. The pair is expected to find its first resistance at 1.3816, and a rise through could take it to the next resistance level of 1.3881.

Investors are eying the Euro-zone Economic and Financial Affairs Council meeting along with economic releases in the Euro-zone to be released later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.