For the 24 hours to 23:00 GMT, USD rose 1.34% against the CHF and closed at 0.9009.

Swiss franc declined against its US counterpart amid poor Swiss consumer price data. The Consumer Price Index (CPI) declined 0.1% (M-o-M) in October, following a 0.3% rise in the previous month. Meanwhile, the jobless rate came in at 3.0% in October.

Yesterday, vice-chairman of the Swiss National Bank, Thomas Jordan, stated that the central bank was prepared to step in and take further measures to weaken the currency.

In the Asian session, at GMT0400, the pair is trading at 0.9040, with the USD trading 0.34% higher from yesterday’s close.

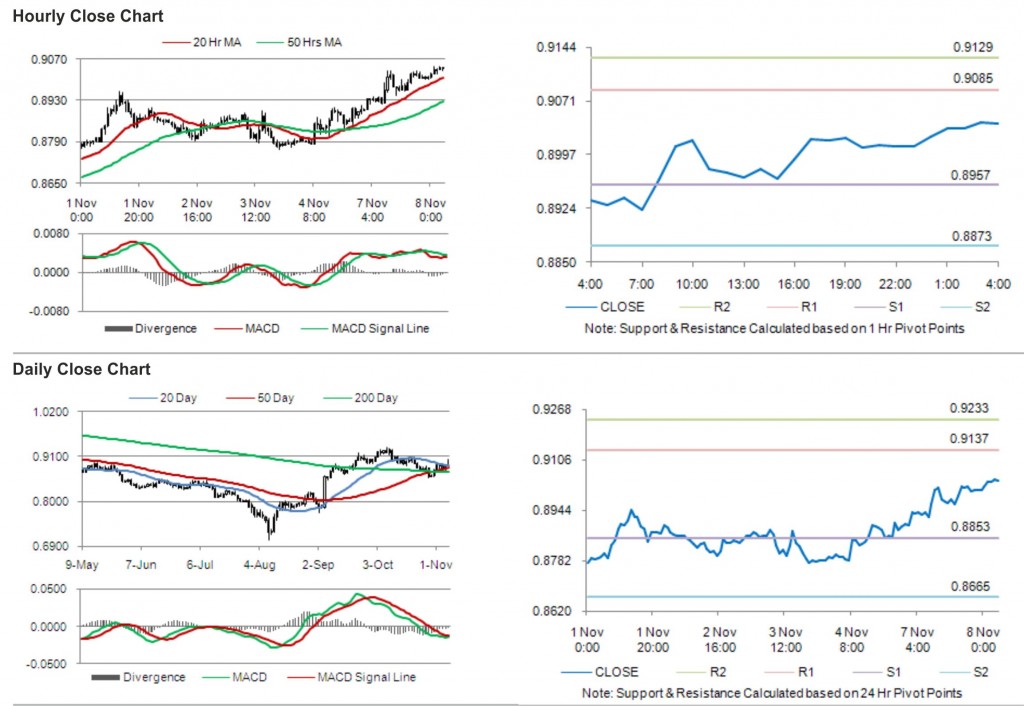

The pair is expected to find support at 0.8957, and a fall through could take it to the next support level of 0.8873. The pair is expected to find its first resistance at 0.9085, and a rise through could take it to the next resistance level of 0.9129.

Trading trends in the pair today are expected to be determined by release of the Swiss National Bank (SNB) Chairman Hildebrand’s speech and SECO consumer climate data in Switzerland.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.