For the 24 hours to 23:00 GMT, EUR declined 1.20% against the USD and closed at 1.3619, amid renewed fears over the Euro-zone debt crisis after the Italian bond auction and poor Euro-zone industrial data.

Italy’s Treasury auctioned €3 billion of five-year government bonds at an average yield of 6.29%, compared to a yield of 5.32% in a previous sale last month. In Greece conservatives vowed yesterday to reject any new austerity measures in return for the aid that is keeping the country away from bankruptcy, signalling a new coalition government may not enjoy the kind of cross-party support its lenders demand.

In economic news, the current account deficit in France widened to €4.0 billion in September, compared to a deficit of €2.4 billion in August. In the Euro-zone, the industrial production rose 2.2% in September (Y-o-Y), compared to 6.0% growth in August.

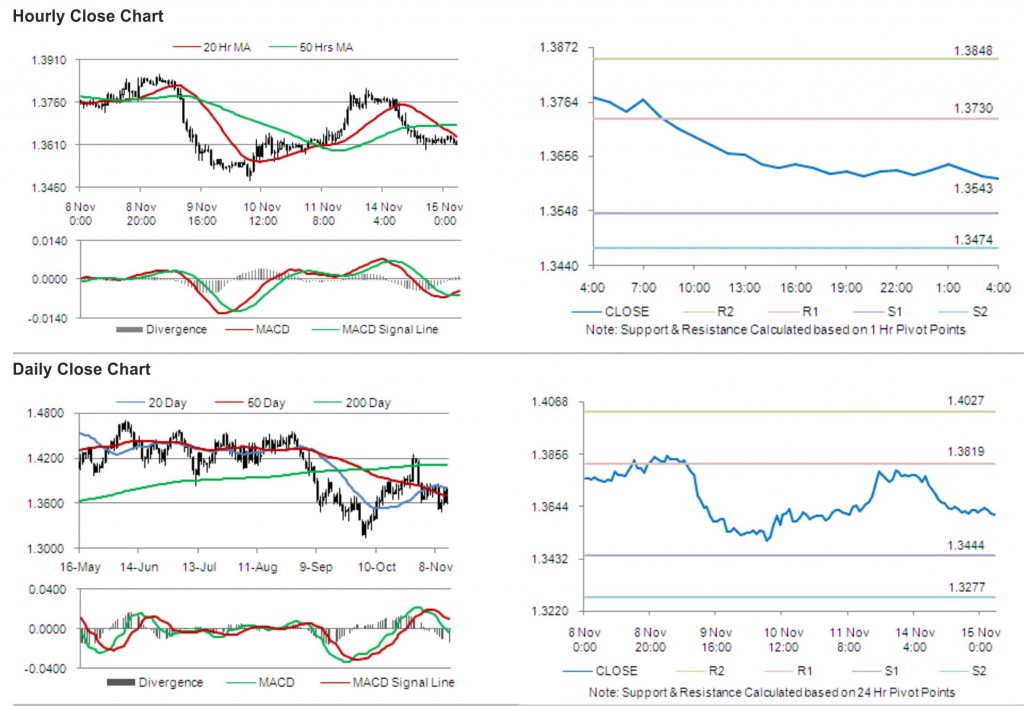

In the Asian session, at GMT0400, the pair is trading at 1.3612, with the EUR trading slightly lower from yesterday’s close.

The pair is expected to find support at 1.3543, and a fall through could take it to the next support level of 1.3474. The pair is expected to find its first resistance at 1.3730, and a rise through could take it to the next resistance level of 1.3848.

With a series of Euro-zone economic releases today, including trade balance and Gross Domestic Product (GDP), trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.