For the 24 hours to 23:00 GMT, AUD weakened 1.32% against the USD to close at 1.0193, as concerns that Europe would struggle to contain its sovereign-debt crisis sapped demand for riskier currencies.

In the Asian session, at GMT0400, the pair is trading at 1.0193, with the AUD trading flat from yesterday’s close, after the Reserve Bank of Australia (RBA) sounded in no hurry to cut rates again.

Minutes of Australia’s central bank monthly policy meeting revealed that it considered leaving rates unchanged in November but decided that lower inflation at home and the debt crisis in Europe warranted a “modest easing” in policy. The Reserve Bank, that reduced that rates by 25 bps to 4.5% earlier this month, gave no hints on whether it may cut again.

LME Copper prices rose 3.8% or $280.5/MT to $7,731.5/ MT. Aluminium prices rose 1.3% or $28.5/MT to $2,144.0/ MT.

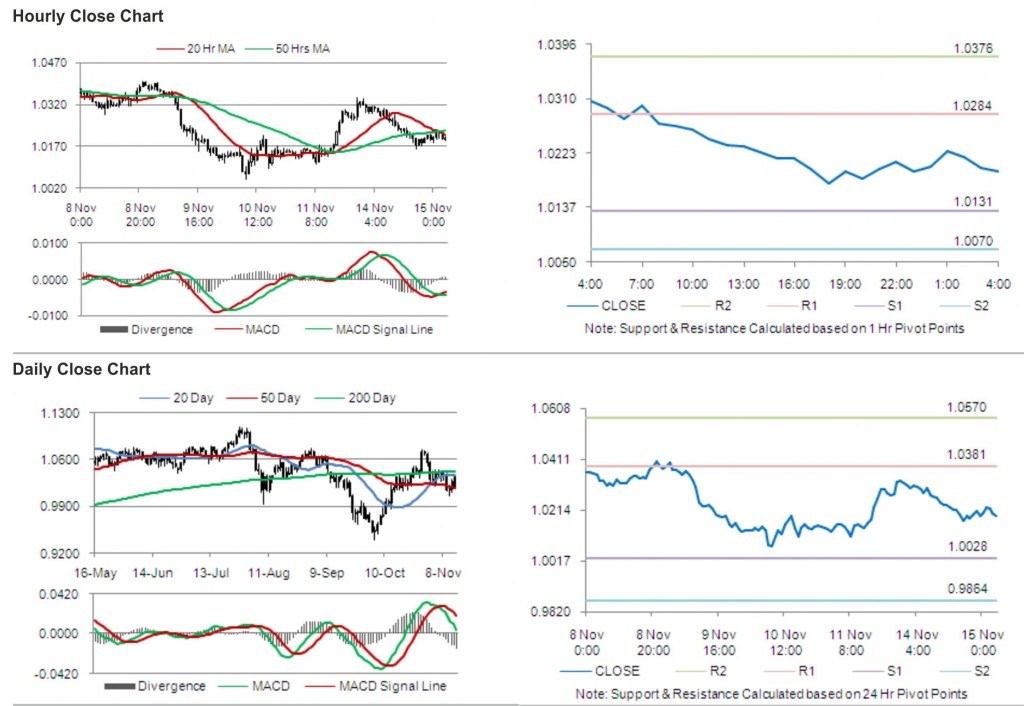

The pair is expected to find support at 1.0131, and a fall through could take it to the next support level of 1.0070. The pair is expected to find its first resistance at 1.0284, and a rise through could take it to the next resistance level of 1.0376.

Trading trends in the pair today are expected to be determined by release of Westpac Leading Index in Australia.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.