For the 24 hours to 23:00 GMT, USD weakened 0.09% against the JPY and closed at 76.97.

Yesterday, the Bank of Japan (BoJ), in its monthly report, stated that exports and production are expected to be more or less flat in the near term and thereafter, it would rise moderately. The BoJ also downgraded the assessment of the economy, citing adverse effects from European debt crisis and the appreciation of yen.

The BoJ Governor, Masaaki Shirakawa stated that the lingering European debt crisis posed considerable downside risks to Japan’s economic prospects.

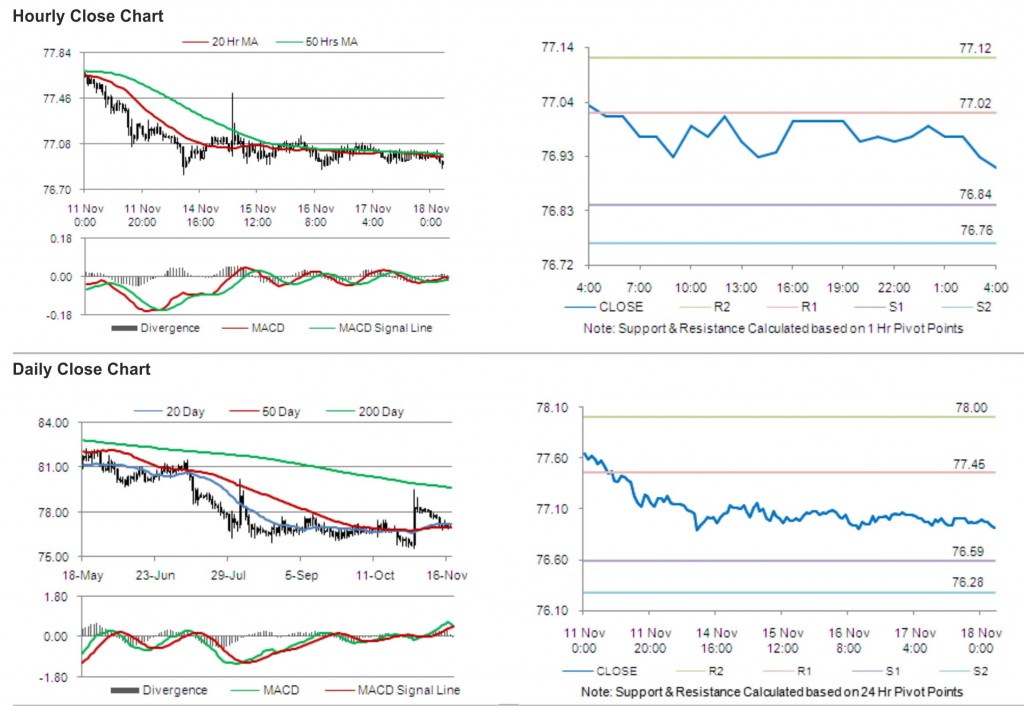

In the Asian session, at GMT0400, the pair is trading at 76.91, with the USD trading 0.08% lower from yesterday’s close.

The pair is expected to find support at 76.84, and a fall through could take it to the next support level of 76.76. The pair is expected to find its first resistance at 77.02, and a rise through could take it to the next resistance level of 77.12.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.