For the 24 hours to 23:00 GMT, EUR rose 0.30% against the USD, on Friday, and closed at 1.3510, amid hopes that technocrats in Italy can assist the nation avert a sovereign debt crisis.

New Italian Prime Minister, Mario Monti has proposed austerity measures in an effort to get the nation’s borrowing costs back to sustainable levels.

In Germany, the Producer Price Index (PPI) rose 0.2% (MoM) in October, compared to a 0.3% growth in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.3529, with the EUR trading 0.14% higher from Friday’s close.

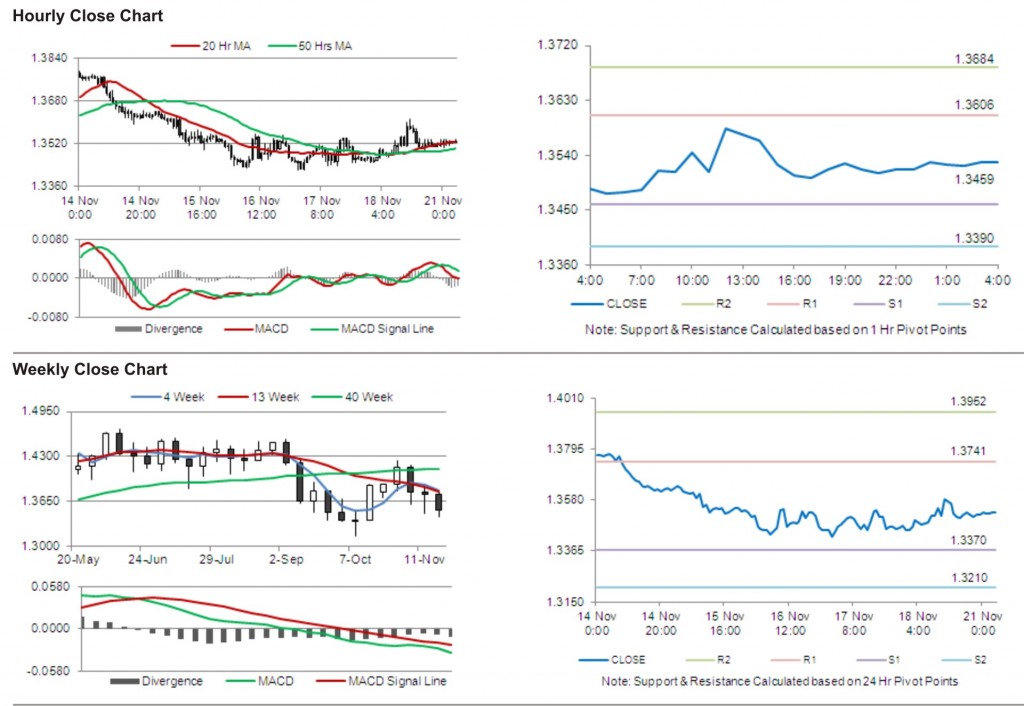

The pair is expected to find support at 1.3459, and a fall through could take it to the next support level of 1.3390. The pair is expected to find its first resistance at 1.3606, and a rise through could take it to the next resistance level of 1.3684.

Trading trends in the pair today are expected to be determined by current account data release in the Euro-zone.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.