For the 24 hours to 23:00 GMT, EUR declined 0.23% against the USD and closed at 1.3485, as concerns over France losing its AAA credit rating spurred investors’ to flock to safe-havens assets.

Moody’s Investors Service cautioned that rising French government borrowing costs and an uncertain economic outlook continue to pose a threat to the outlook for France’s AAA credit rating.

Additionally, German’s Deputy Finance Minister, Joerg Asmussen stated that the country’s economy is expanding at a markedly slower pace in the final quarter of the year as demand for exports moderated. He further added that the economy grew 0.5% in the third quarter largely due to domestic demand.

In economic news, the current account balance in the Euro-zone showed a surplus of €500 million in September, following a deficit of €5.9 billion in August.

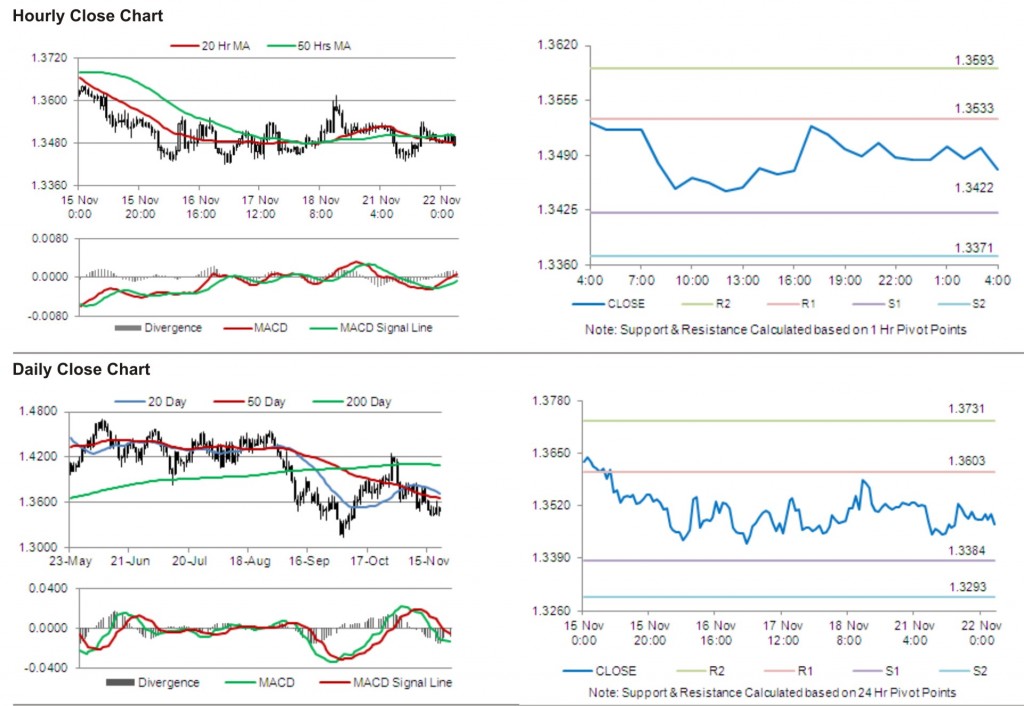

In the Asian session, at GMT0400, the pair is trading at 1.3474, with the EUR trading 0.08% lower from yesterday’s close.

The pair is expected to find support at 1.3422, and a fall through could take it to the next support level of 1.3371. The pair is expected to find its first resistance at 1.3533, and a rise through could take it to the next resistance level of 1.3593.

Trading trends in the pair today are expected to be determined by release of consumer confidence data in the Euro-zone.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.