For the 24 hours to 23:00 GMT, GBP fell 0.87% against the USD and closed at 1.5643, amid poor UK housing data. The Rightmove House Price Index declined 3.1% (MoM) in November, following 2.8% rise in the previous month.

Bank of England (BoE) policymaker, Adam Posen stated that the US Federal Reserve and the European Central Bank (ECB) must purchase more government securities to bring down borrowing costs and stimulate their economies.

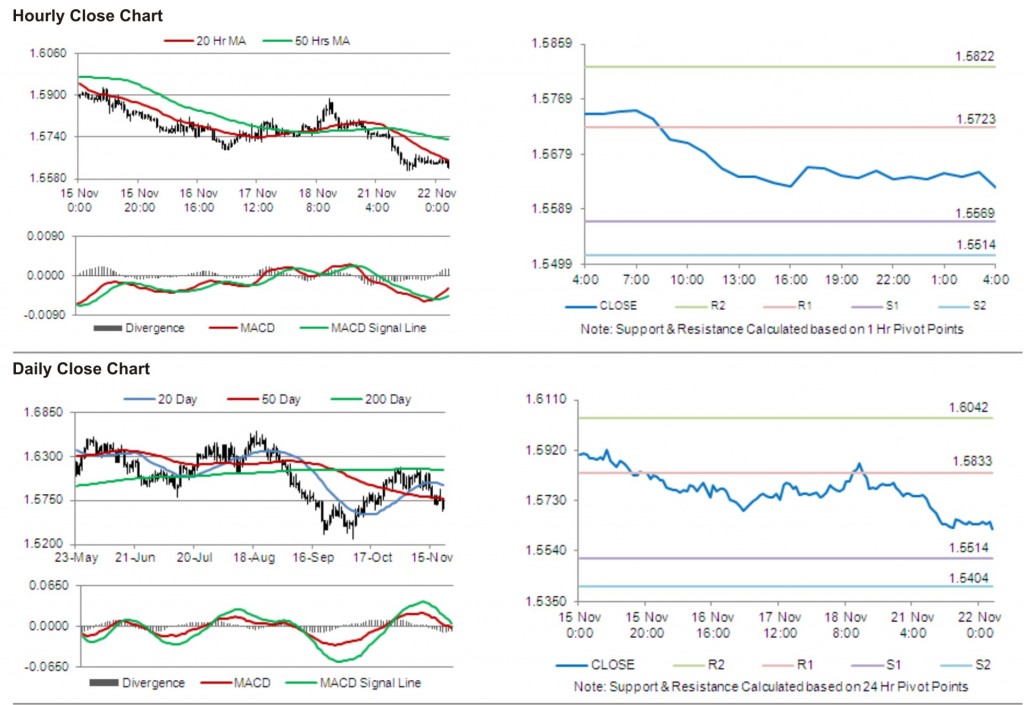

In the Asian session, at GMT0400, the pair is trading at 1.5624, with the GBP trading 0.12% lower from yesterday’s close.

The pair is expected to find support at 1.5569, and a fall through could take it to the next support level of 1.5514. The pair is expected to find its first resistance at 1.5723, and a rise through could take it to the next resistance level of 1.5822.

The pair is expected to trade on the cues from the release of public sector net borrowing data in the UK.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.