For the 24 hours to 23:00 GMT, EUR rose 0.84% against the USD and closed at 1.3439, after the coordinated central bank action to make more funds available to lenders to help contain the Europe’s debt crisis.

The U.S. Federal Reserve, the European Central Bank, the Bank of England, the Bank of Japan, the Bank of Canada and the Swiss National Bank extended existing swap lines for banks to borrow dollars and lowered the cost of using them to ease worries in financial markets.

In the Euro-zone, the Consumer Price Inflation (CPI) remained unchanged at 3.0% (YoY) in November, compared to the previous month. The unemployment rate rose to 10.3% in October, compared to 10.2% in September.

In Germany, the jobless rate fell to 6.9% in November, from 7.0% in October. Meanwhile, in France, the Producer Price Index (PPI) rose 0.4% in October, compared to a 0.2% rise in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.3452, with the EUR trading 0.10% higher from yesterday’s close.

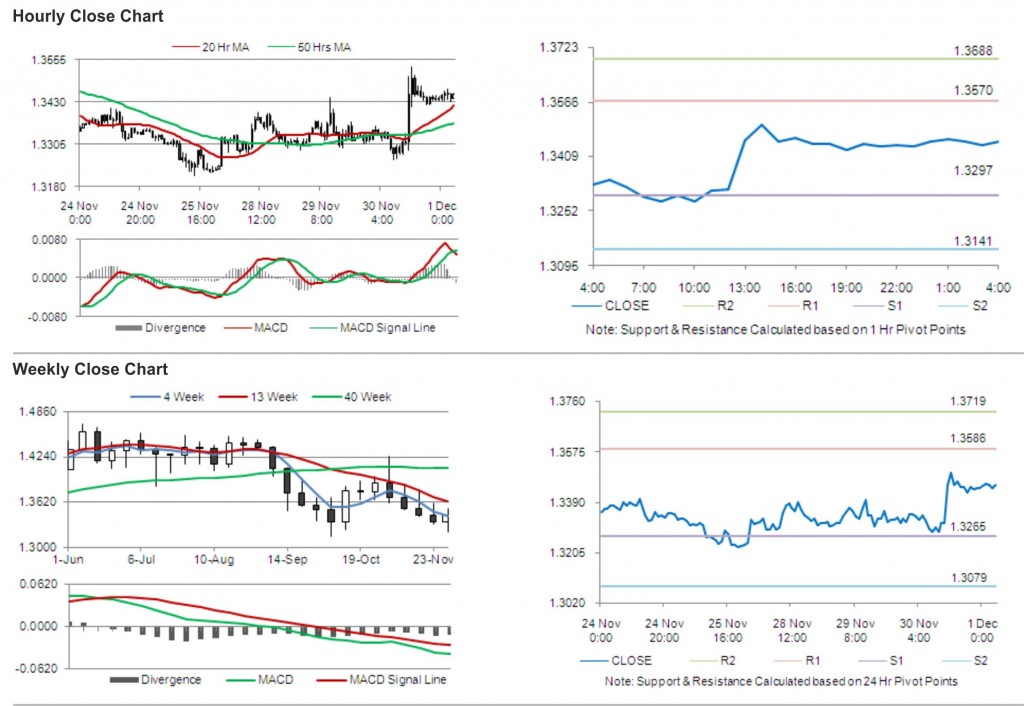

The pair is expected to find support at 1.3297, and a fall through could take it to the next support level of 1.3141. The pair is expected to find its first resistance at 1.3570, and a rise through could take it to the next resistance level of 1.3688.

Trading trends in the pair today are expected to be determined by release of manufacturing Purchasing Managers’ Index (PMI) in the Euro-zone and unemployment data in France.

The currency pair is trading above its 20 Hr and its 50 Hr moving averages.