For the 24 hours to 23:00 GMT, GBP rose 0.59% against the USD and closed at 1.5696. The greenback came under heavy pressure, as investors cheered a coordinated central bank action to provide liquidity to the financial sector. Investors risk appetite increase, driving the dollar lower despite a slew of positive news on the US economy.

In the Asian session, at GMT0400, the pair is trading at 1.5693, with the GBP trading flat from yesterday’s close.

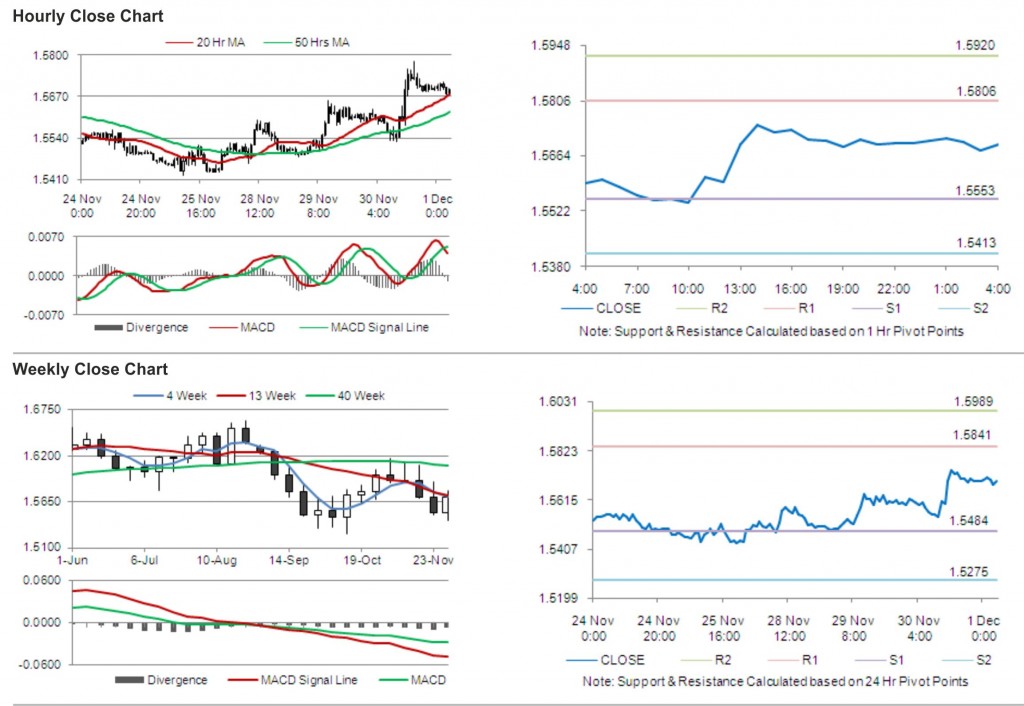

The pair is expected to find support at 1.5553, and a fall through could take it to the next support level of 1.5413. The pair is expected to find its first resistance at 1.5806, and a rise through could take it to the next resistance level of 1.5920.

Trading trends in the pair today are expected to be determined by release of manufacturing Purchasing Manager Index (PMI) and Halifax house prices data in the UK.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.