For the 24 hours to 23:00 GMT, USD declined 1.22% against the CAD to close at 1.0187.

Canadian dollar rose sharply against the greenback, boosted by Canadian Gross Domestic Product (GDP) data and coordinated action by Central Banks including the Bank of Canada to reduce the cost of emergency dollar funding to ease Europe’s sovereign-debt crisis.

Gross Domestic Product (GDP) in Canada grew at an annualised rate of 3.5% in the third quarter, after declining 0.5% in the prior three months. Meanwhile, the Industrial Product Price Index in Canada declined 0.1% (MoM) in October, while the Raw Materials Price Index fell 1.2% in October.

In the Asian session, at GMT0400, the pair is trading at 1.0188, with the USD trading flat from yesterday’s close.

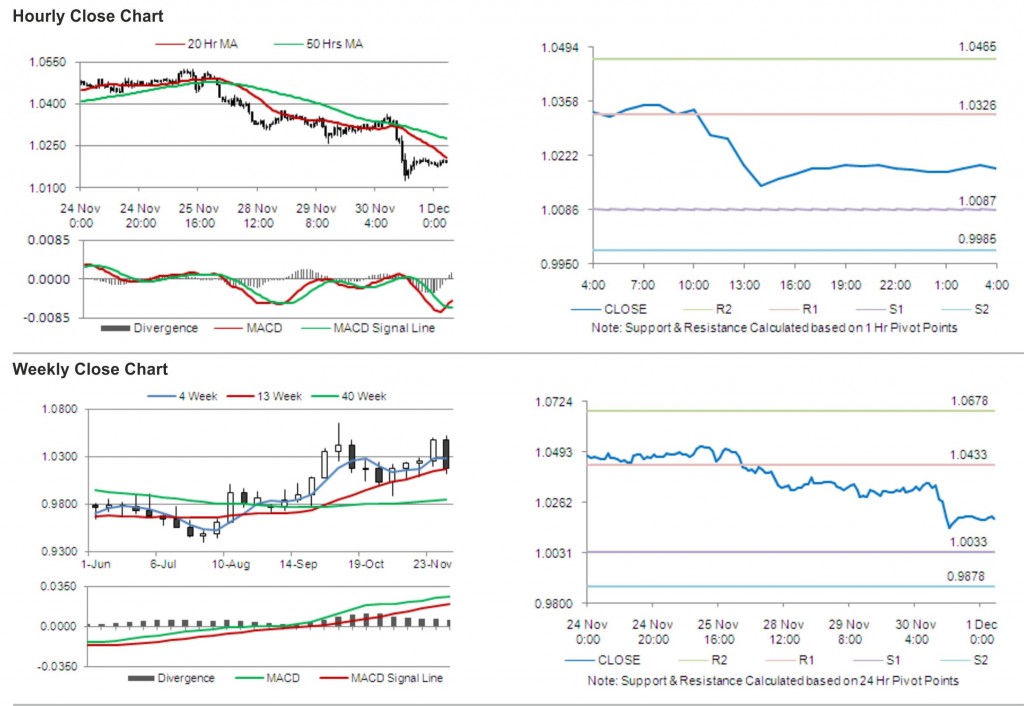

The pair is expected to find support at 1.0087, and a fall through could take it to the next support level of 0.9985. The pair is expected to find its first resistance at 1.0326, and a rise through could take it to the next resistance level of 1.0465.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.