Oil prices advanced 0.92% against the USD for the 24 hour period ending 23:00GMT, closing at 100.51, after the Federal Reserve along with five other central banks made additional funds available to ease worries from European debt crisis, renewed hopes for improved liquidity in the international financial system.

The Energy Information Administration reported that crude-oil inventories rose 3.9 million barrels in the week ended November 25. Gasoline supplies up 200,000 barrels, while distillates inventories rose 5.5 million.

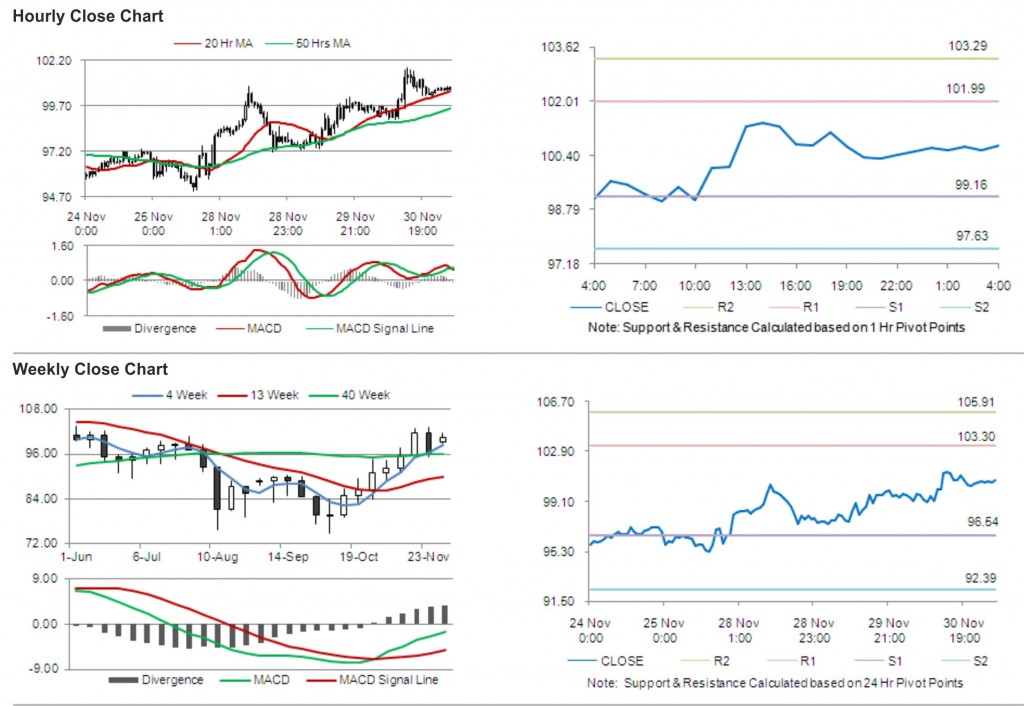

In the Asian session, at GMT0400, Crude Oil is trading at 100.70, 0.19% higher from yesterday’s close.

Crude oil is expected to find support at 99.16, and a fall through could take it to the next support level of 97.63. Crude oil is expected to find its first resistance at 101.99, and a rise through could take it to the next resistance level of 103.29.

The pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.