For the 24 hours to 23:00 GMT, EUR declined 0.40% against the USD and closed at 1.2986, as a surge in the Italian borrowing costs, renewed fears about the European debt crisis. Italian Treasury sold €3 billion of 5-year bonds and saw yields surge to 6.47%, the highest yield at auction since the euro-era.

In the Euro-zone, industrial output declined 0.1% (MoM) in October, compared to a 2.0% drop in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.2991, with the EUR trading 0.04% higher from yesterday’s close.

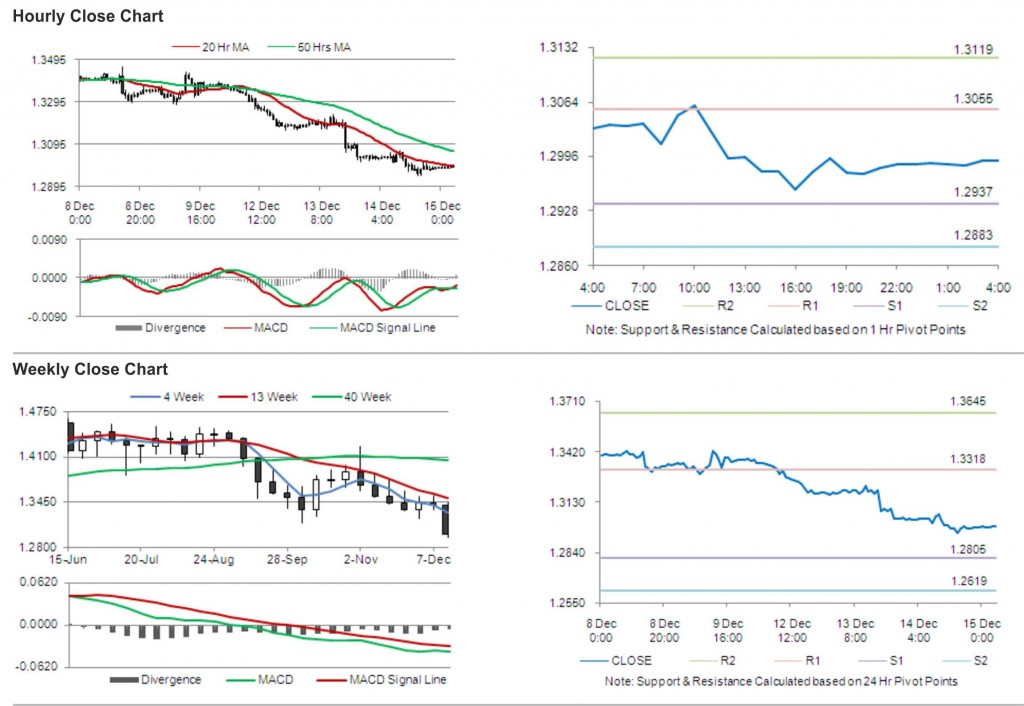

The pair is expected to find support at 1.2937, and a fall through could take it to the next support level of 1.2883. The pair is expected to find its first resistance at 1.3055, and a rise through could take it to the next resistance level of 1.3119.

With a series of Euro-zone economic releases today, including Purchasing Manager Index (PMI) and Consumer Price Index (CPI), trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.