For the 24 hours to 23:00 GMT, USD rose 0.50% against the CAD to close at 1.0389.

Canadian dollar fell against greenback, as renewed European debt worries curbed demand for riskier assets, and as fall in commodity prices further added to the decline.

In economic news, manufacturing sales in Canada fell 0.8% (MoM) in October to C$48.7 billion. Additionally, the Royal Bank of Canada reported that, the composite index of leading indicators in Canada rose 0.8% (MoM) in November, following an upwardly revised 0.3% gain in October.

In the Asian session, at GMT0400, the pair is trading at 1.0383, with the USD trading 0.06% lower from yesterday’s close.

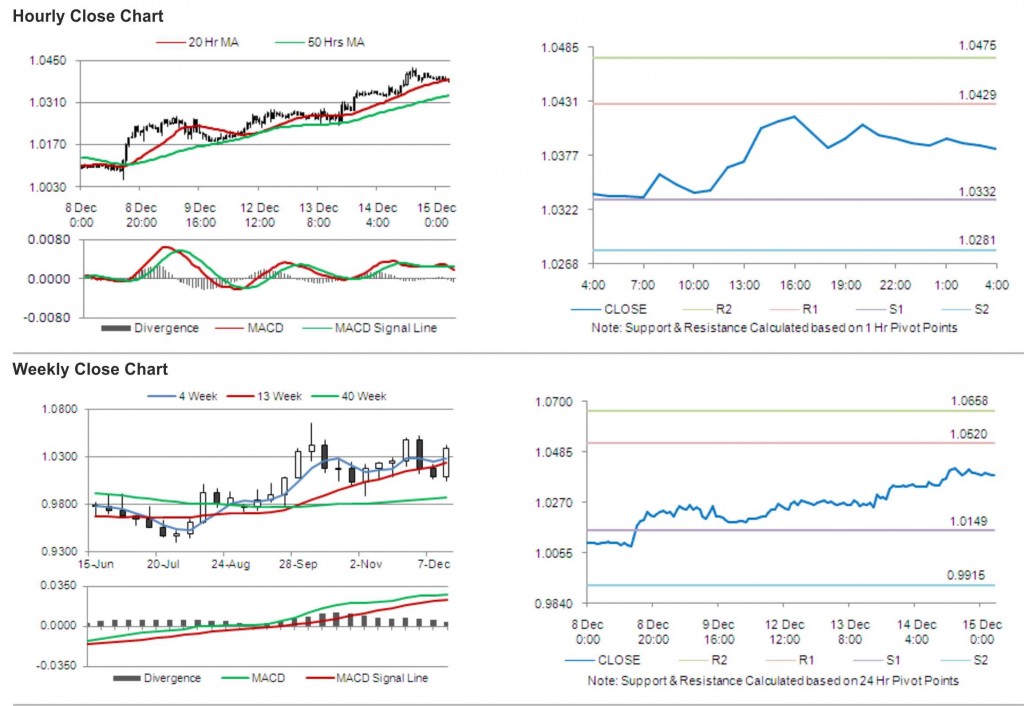

The pair is expected to find support at 1.0332, and a fall through could take it to the next support level of 1.0281. The pair is expected to find its first resistance at 1.0429, and a rise through could take it to the next resistance level of 1.0475.

Trading trends in the pair today are expected to be determined by release of capacity utilization data in Canada.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.