For the 24 hours to 23:00 GMT, JPY weakened 0.92% against the USD and closed at 77.69, after the Bank of Japan (BoJ) trimmed its economic growth forecasts through fiscal 2012, and keeping its interest-rate target unchanged.

Bank of Japan Governor, Masaaki Shirakawa stated that the timing of Japan’s recovery has been delayed somewhat due to a slowdown in global economic growth and a strong yen.

In the Asian session, at GMT0400, the pair is trading at 77.96, with the USD trading 0.34% higher from yesterday’s close.

Yen came under pressure after the merchandise trade deficit in Japan narrowed to ¥496.53 billion in December, compared to a revised deficit of ¥687.6 billion in November. Also, Ministry of Finance data showed that Japan’s trade deficit stood at ¥2.49 trillion for 2011, the first annual deficit since 1980.

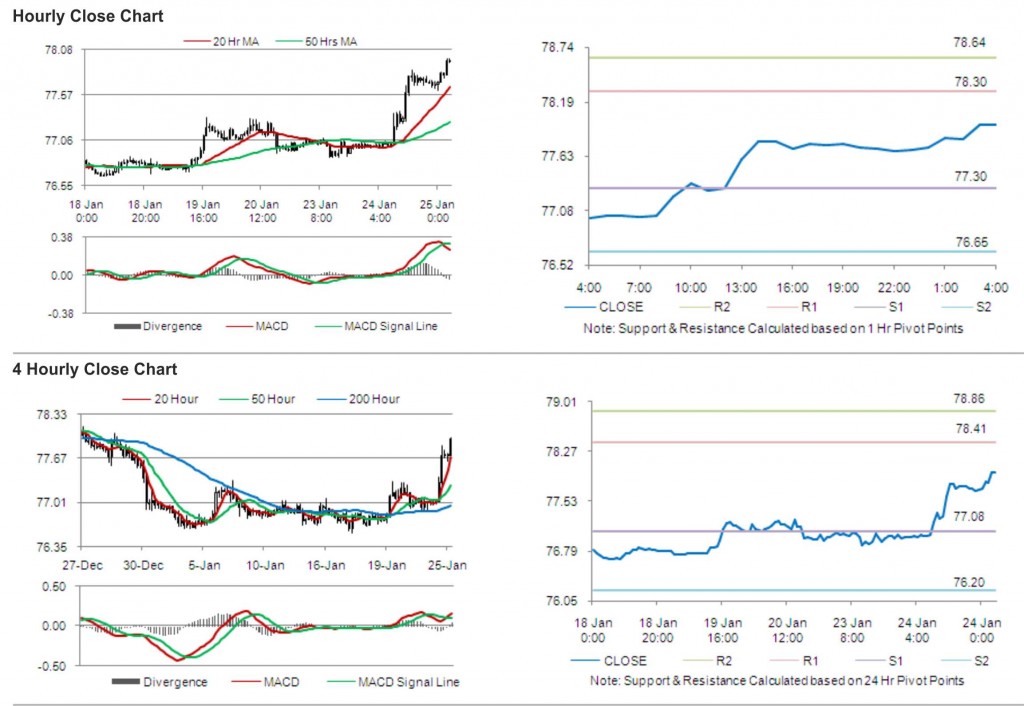

The pair is expected to find support at 77.30, and a fall through could take it to the next support level of 76.65. The pair is expected to find its first resistance at 78.30, and a rise through could take it to the next resistance level of 78.64.

The currency pair is trading well above its 20 Hr and its 50 Hr moving averages.