Oil prices advanced 0.68% against the USD for the 24 hour period ending 23:00GMT, closing at 99.86, after the Federal Reserve stated that it planned to keep interest rates low at least through late 2014, to boost the economic growth, raising fuel demand.

Meanwhile, the US Energy Information Administration reported a 3.6 million-barrel rise in crude oil inventories for the week ended January 20. Motor gasoline supplies fell 400,000 barrels, while distillate stocks dropped by 2.5 million barrels.

Additionally, the Chinese government stated that country’s apparent oil demand climbed 6.1% to 460.65 million metric tons in 2011.

In the Asian session, at GMT0400, Crude Oil is trading flat at 99.86, from yesterday’s close.

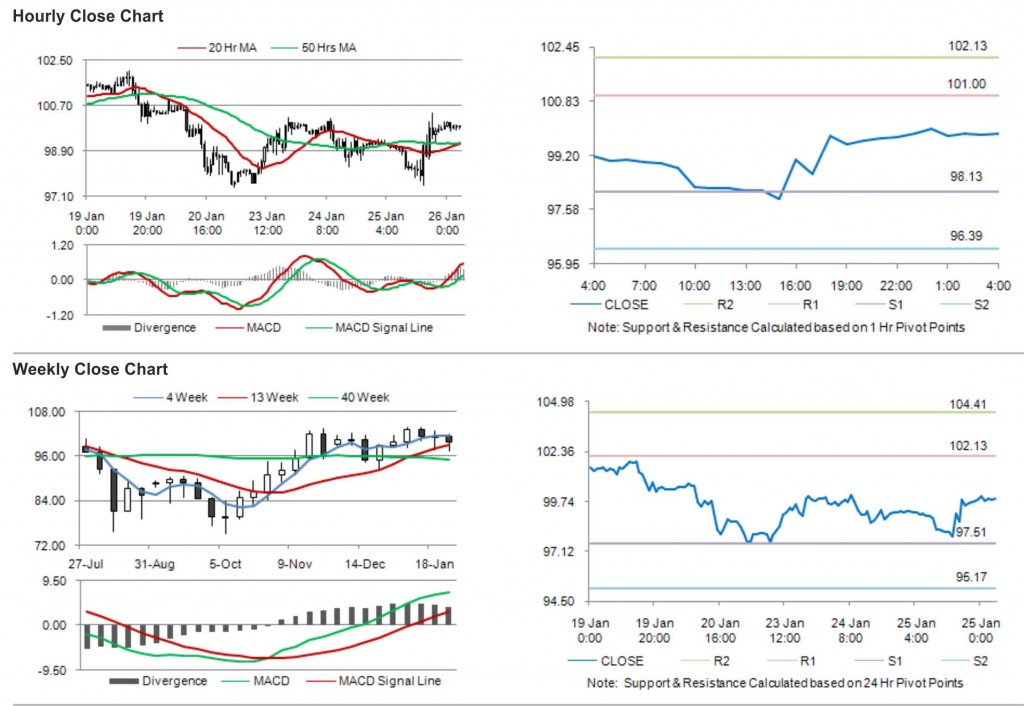

Crude oil is expected to find support at 98.13, and a fall through could take it to the next support level of 96.39. Crude oil is expected to find its first resistance at 101.00, and a rise through could take it to the next resistance level of 102.13.

Crude oil is trading well above its 20 Hr and its 50 Hr moving averages.