For the 24 hours to 23:00 GMT, EUR declined 0.41% against the USD and closed at 1.3087.

Earlier in the day, Euro rose after the Greece Prime Minister, Lucas Papademos, stated that he is “strongly committed” to reaching a debt-swap agreement with the country’s creditors.

Meanwhile, members of the European Union, except the UK and Czech Republic, have agreed to sign up for the new fiscal compact, aimed at a stricter budget discipline and greater accountability.

The gains were however short-lived as worries over Portugal’s debts and an unexpectedly poor US economic data supported risk aversion and weighed on Euro.

In economic news, retail sales in Germany fell 1.4% (MoM) in December, while the unemployment rate declined to 6.7% in January. Additionally, the unemployment rate in the Euro-zone rose to 10.4% in December, on a par with an upwardly revised November figure.

Meanwhile in the US, consumer confidence fell unexpectedly to 61.1, while the Institute for Supply Management (ISM) Chicago reported that its business barometer unexpectedly dropped to a reading of 60.2 in January.

Separately, French Prime Minister, Francois Fillon stated that the nation has lowered its economic growth forecast for 2012 to 0.5% from 1.0%, but added that it’s cautious 2012 budget allowed it to avoid further belt tightening measures.

In the Asian session, at GMT0400, the pair is trading at 1.3072, with the EUR trading 0.11% lower from yesterday’s close.

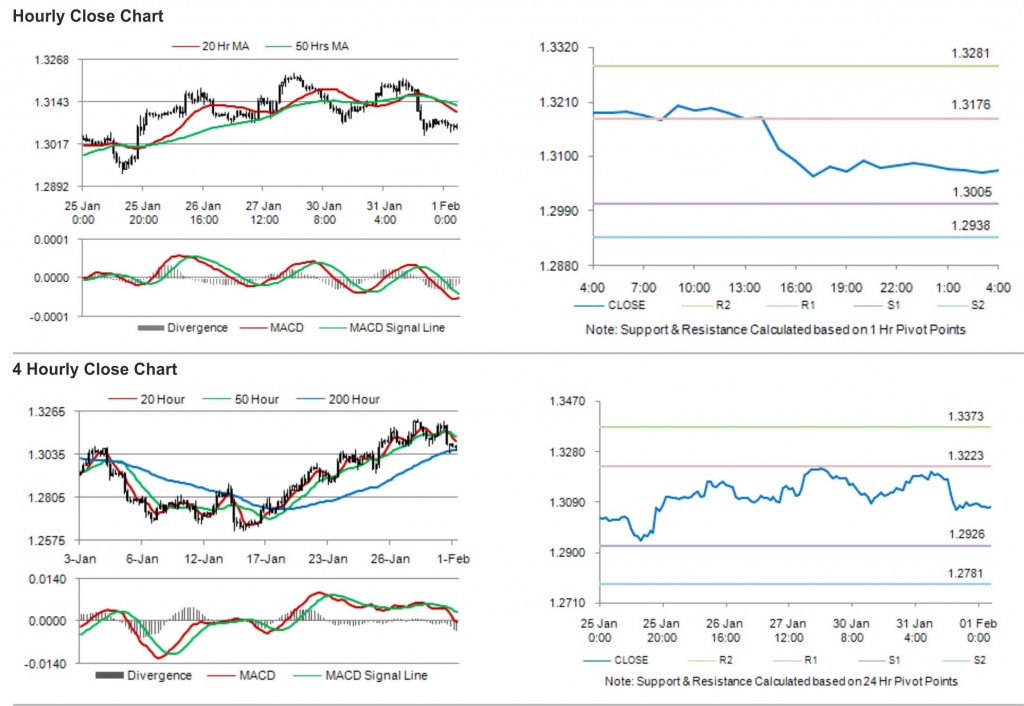

The pair is expected to find support at 1.3005, and a fall through could take it to the next support level of 1.2938. The pair is expected to find its first resistance at 1.3176, and a rise through could take it to the next resistance level of 1.3281.

Trading trends in the pair today are expected to be determined by the release of manufacturing Purchasing Manager Index and Consumer Price Index estimate in the Euro-zone.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.