Oil prices declined 1.13% against the USD for the 24 hour period ending 23:00GMT, closing at 97.34, as a higher-than-expected surge in crude oil stock piles outweighed robust manufacturing data in China and the US.

Yesterday, the Energy Information Administration reported that, in the week ended January 27, crude-oil inventories edged up by 4.2 million barrels. Meanwhile, gasoline inventories advanced 3 million barrels, and supplies of distillates dropped by 100,000 barrels.

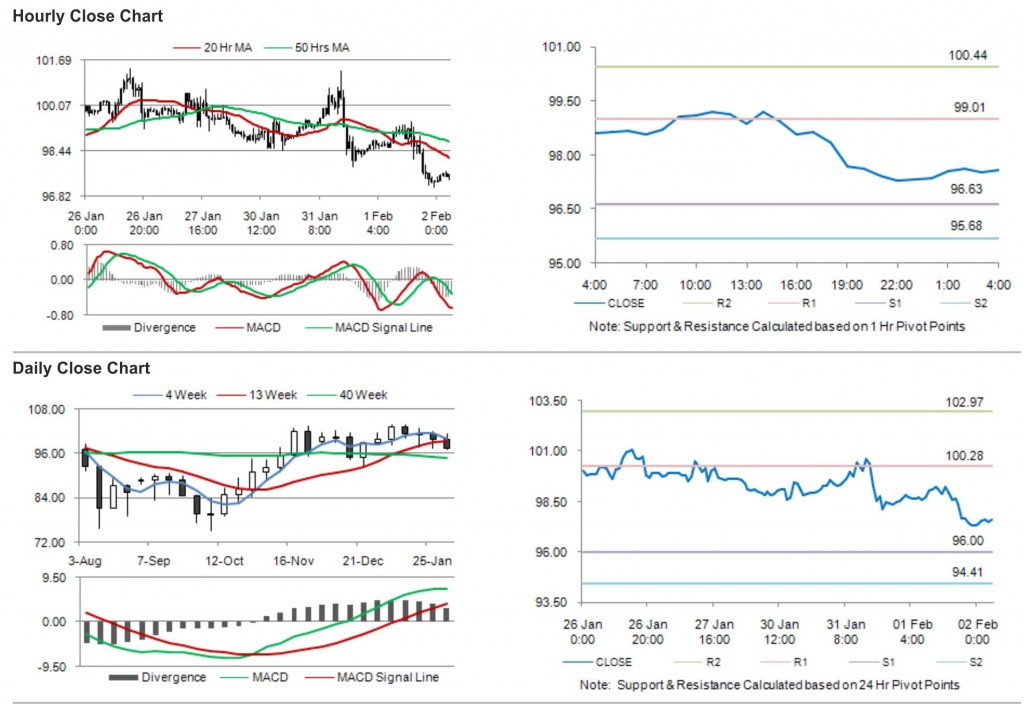

In the Asian session, at GMT0400, Crude Oil is trading at 97.58, 0.25% higher from yesterday’s close.

Crude oil is expected to find support at 96.63, and a fall through could take it to the next support level of 95.68. Crude oil is expected to find its first resistance at 99.01, and a rise through could take it to the next resistance level of 100.44.

The pair is trading below its 20 Hr and 50 Hr moving averages.