On Friday, for the 24 hours to 23:00 GMT, USD declined 0.61% against the CAD to close at 0.9932.

Canadian dollar advanced as stronger economic data from the US, nation’s biggest trade partner, supported appetite for riskier assets. The unemployment rate in the US dropped to 8.3% in January, while the non-manufacturing index climbed to 56.8 in January. Additionally, the factory orders climbed 1.1% (MoM) in December.

In Canadian economic news, the unemployment rate rose to 7.6% in January, compared to a rate of 7.5% in the previous month.

In the Asian session, at GMT0400, the pair is trading at 0.9947, with the USD trading 0.14% higher from Friday’s close.

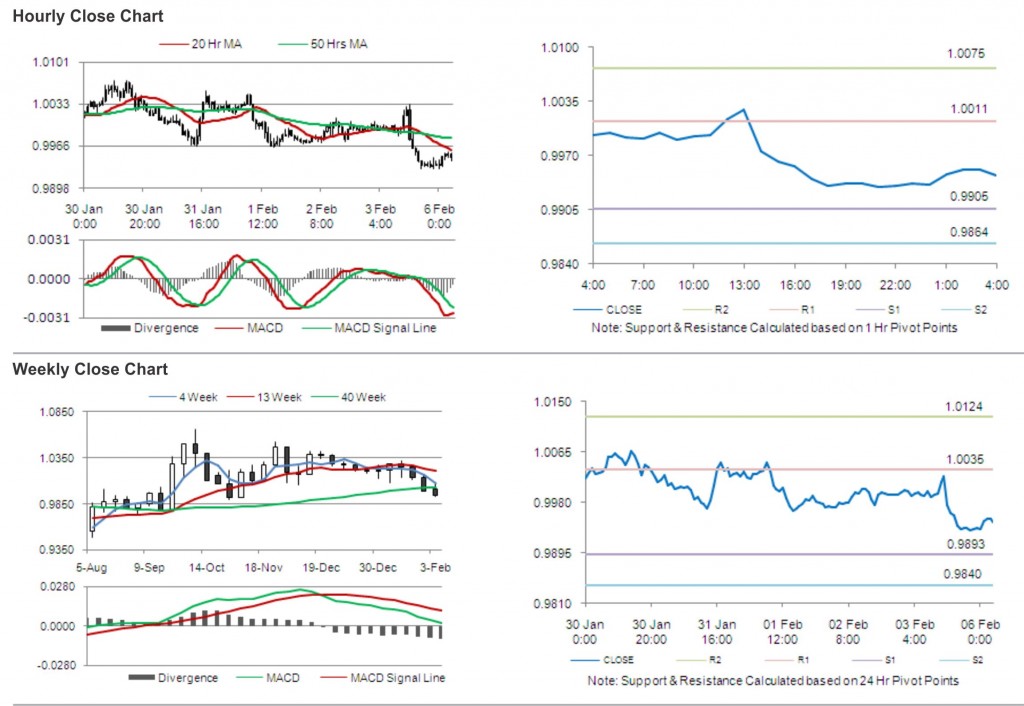

The pair is expected to find support at 0.9905, and a fall through could take it to the next support level of 0.9864. The pair is expected to find its first resistance at 1.0011, and a rise through could take it to the next resistance level of 1.0075.

Trading trends in the pair today are expected to be determined by the release of Ivey Purchasing Managers Index data.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.