For the 24 hours to 23:00 GMT, USD strengthened 0.29% against the JPY and closed at 76.79.

In Japan, Leading Index climbed to 94.3 in December, while the Coincident Index edged up to 93.2 in December.

Data released this morning showed that the current account surplus in Japan widened to ¥303.05 billion in December from ¥138.5 billion posted in November. Additionally, the trade deficit in Japan narrowed to ¥145.8 billion in December, compared to a deficit of ¥585.1 billion recorded in the previous month.

Separately, overall bank lending in Japan advanced 0.7% (YoY) to ¥396.734 trillion in January.

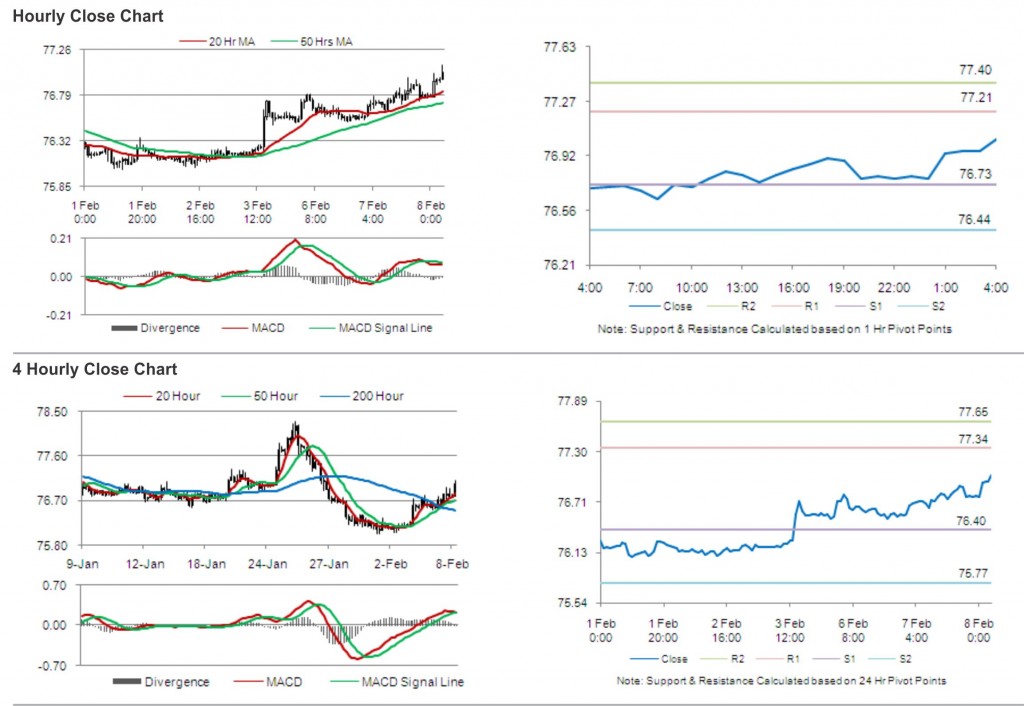

In the Asian session, at GMT0400, the pair is trading at 77.02, with the USD trading 0.31% higher from yesterday’s close.

The pair is expected to find support at 76.73, and a fall through could take it to the next support level of 76.44. The pair is expected to find its first resistance at 77.21, and a rise through could take it to the next resistance level of 77.40.

The pair is expected to trade on the cues from the release of eco watchers survey for current and outlook and housing loans data in Japan, later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.