For the 24 hours to 23:00 GMT, EUR declined 0.27% against the USD and closed at 1.3224, after the release of disappointing economic data in the Euro-zone.

In economic news, German trade surplus narrowed to €12.9 billion in December, compared to a surplus of €15.9 billion recorded in November. Additionally, French central government’s budget deficit fell to €90.8 billion in 2011, compared to a deficit of €148.8 billion recorded a year earlier. Moreover, the Business Confidence Index in France stood at a reading of 96.0 in January, unchanged from the previous month’s upwardly revised reading.

The EUR received some support after the sale of Germany’s 0.75% 5-year Federal Notes attracted bids totaling €5.871 billion against the €4 billion target set for the auction.

The country raised €3.293 billion from the sale of the debt maturing in February 2017, at the yield of 0.91%, broadly unchanged from the 0.90% paid at the previous auction.

Meanwhile, talks between Greece and international creditors over a second bailout appeared to be moving toward a conclusion after the European Central Bank reportedly agreed to exchange Greek government bonds at less than face value in an effort to further reduce the nation’s debt load.

Additionally, late yesterday, Bloomberg News reported that Greece promised to reduce the minimum wage by 20% and lower pension payments as part of a deal with the EU and IMF to secure funds.

In the Asian session, at GMT0400, the pair is trading at 1.3255, with the EUR trading 0.24% higher from yesterday’s close, on optimism that Greece has moved closer to a deal to ensure further financing from the European Union and International Monetary Fund.

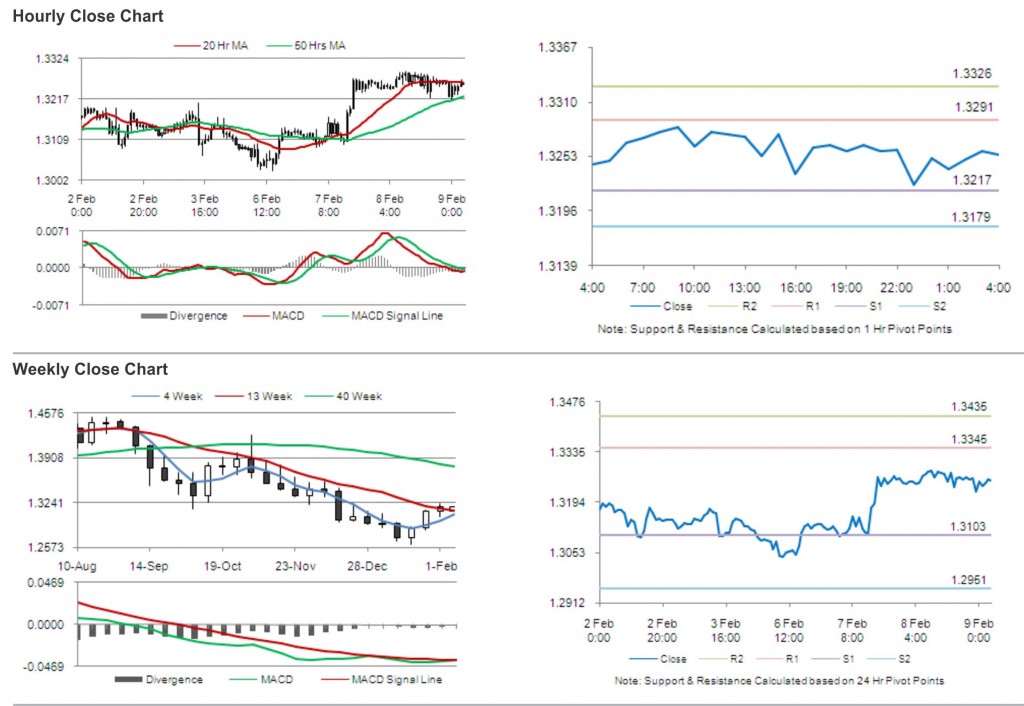

The pair is expected to find support at 1.3217, and a fall through could take it to the next support level of 1.3179. The pair is expected to find its first resistance at 1.3291, and a rise through could take it to the next resistance level of 1.3326.

Trading trends in the pair today are expected to be determined by European Central Bank (ECB) rate decision later today.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.