For the 24 hours to 23:00 GMT, USD strengthened 0.36% against the JPY and closed at 77.06.

Yen declined after the Japanese Economic Watchers’ survey results showed that the Current Conditions Index declined to 44.1 in January, compared to 47.0 in December. Meanwhile, the Outlook Index edged up to 47.1, from 44.4 in December.

In the Asian session, at GMT0400, the pair is trading at 77.18, with the USD trading 0.15% higher from yesterday’s close, as yen came under pressure after core machinery orders in Japan fell 7.1% (MoM) in December. Separately, the M3 money supply in Japan climbed 2.6% (YoY) in January.

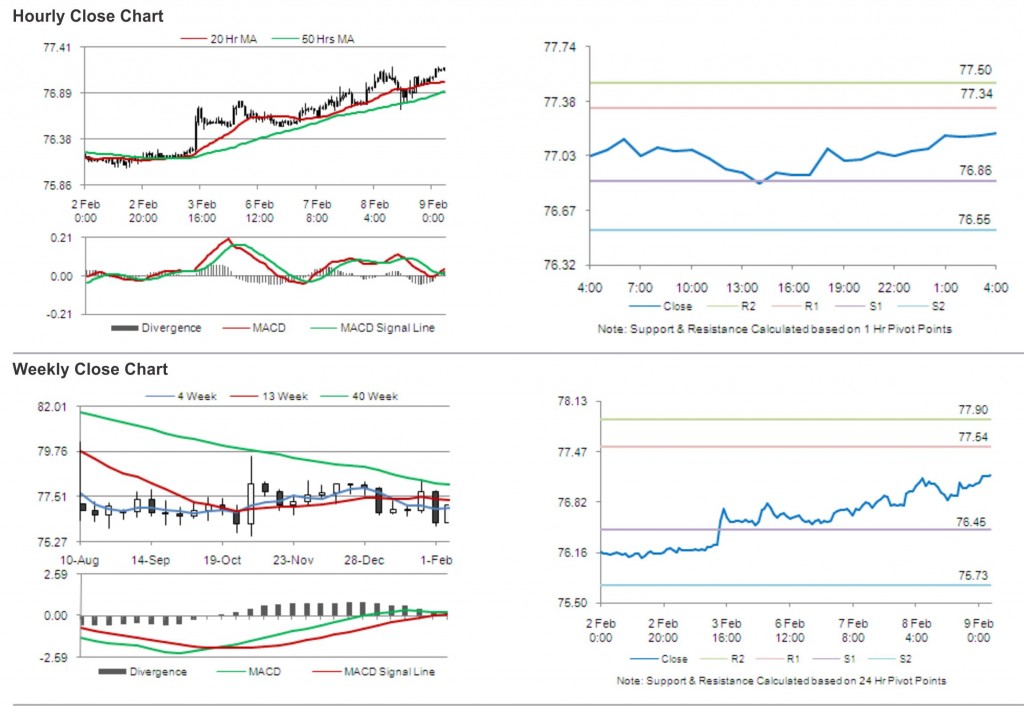

The pair is expected to find support at 76.86, and a fall through could take it to the next support level of 76.55. The pair is expected to find its first resistance at 77.34, and a rise through could take it to the next resistance level of 77.50.

Yen is likely to receive increased market attention, with consumer confidence index data due to be released later today.

The currency pair is trading above its 20 Hr and 50 Hr moving average.