On Friday, Oil prices advanced 1.21% against the USD for the 24 hour period ending 23:00GMT, closing at 103.53, supported by lingering geopolitical concerns and rising optimism over the resolution of the Greek debt.

On Friday, in its monthly report, American Petroleum Institute reported that US oil usage in January dropped 5.7% from a year ago to 18.026 million barrels per day.

In the Asian session, at GMT0400, Crude Oil is trading at 104.95, 1.37% higher from Friday’s close, amid report from Iran’s oil ministry that the nation halted crude exports to France and the UK. Oil prices further found support after China cut reserve ratios at its banks to support lending and economic growth.

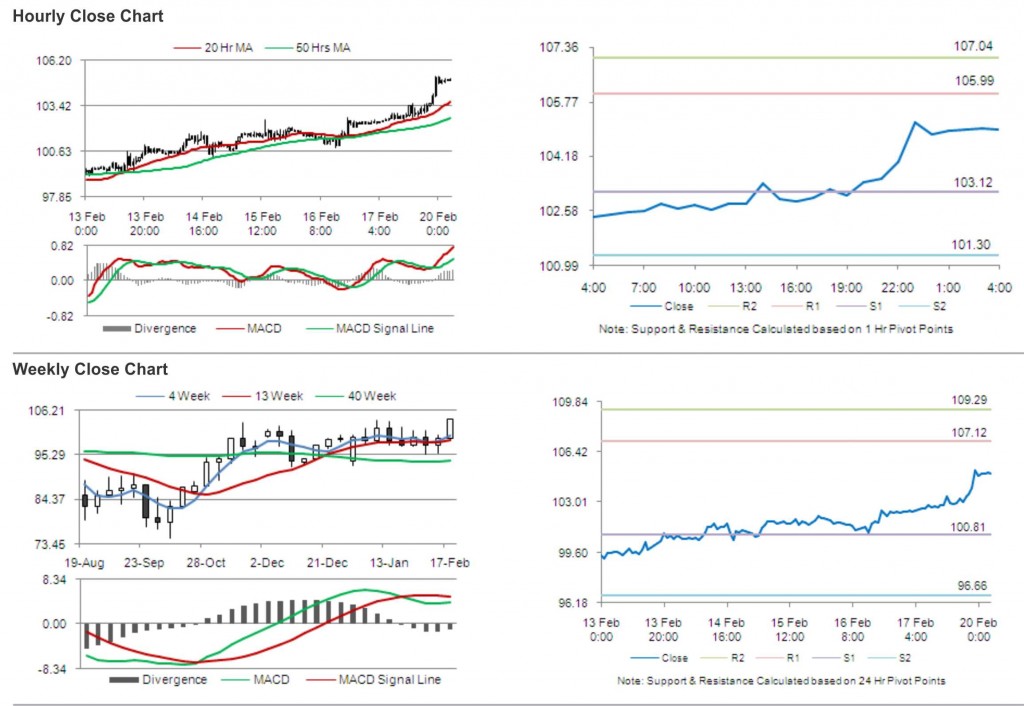

Crude oil is expected to find support at 103.12, and a fall through could take it to the next support level of 101.30. Crude oil is expected to find its first resistance at 105.99, and a rise through could take it to the next resistance level of 107.04.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.