For the 24 hours to 23:00 GMT, EUR declined 0.01% against the USD and closed at 1.3232. Despite the announcement of a new bailout package, the Euro could not hold on its initial gains, amid uncertainty over the implementation of the second Greek bailout and on concerns that the deal is only a short-term fix.

Yesterday, the Euro-zone Finance Ministers struck the deal for the second bailout for Greece that includes new financing of €130 billion. Private sector holders of Greek debt are expected to take losses of up to 53.5% on the nominal value of their bonds.

Meanwhile, on the economic front, the Consumer Confidence Index in the Euro-zone climbed to -20.2 in February, and compared to a revised reading of -20.7 recorded in January.

Yesterday, the Spanish government sold €2.5 billion in three- and six-month bonds, amid strong demand, with the average yield on the three-month bill declining to 0.396%, from 1.285% last month, while it was 0.779% on the six-month, down from 1.847%. Additionally, Italy sold €12 billion of T-bills, meeting its target for the auction, while borrowing costs fell to the lowest since June from the previous sale.

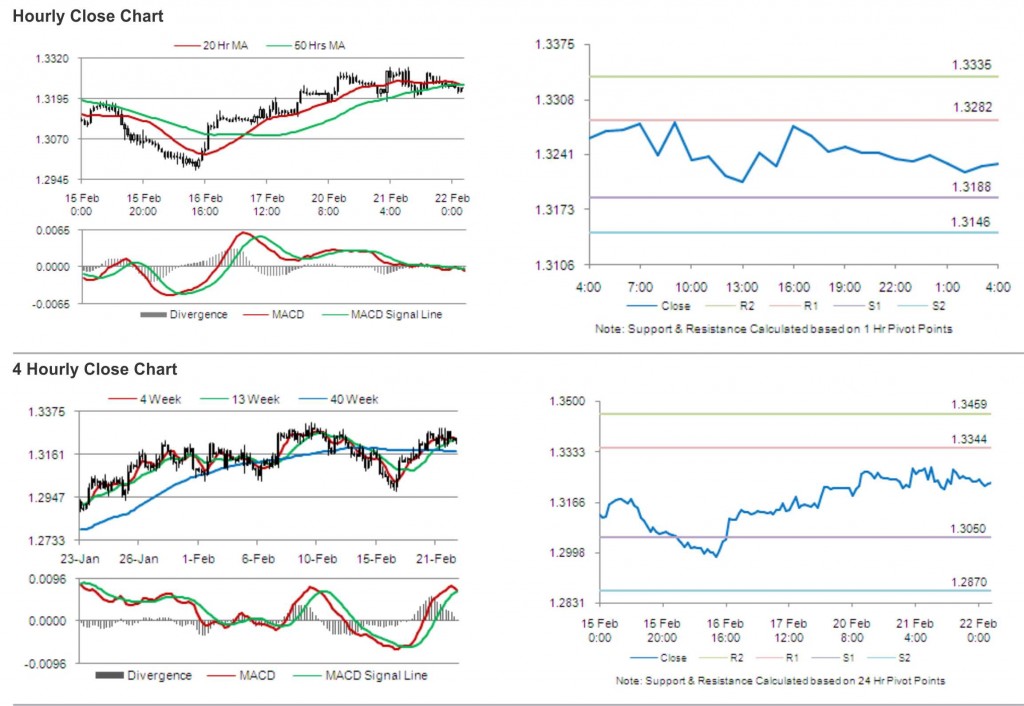

In the Asian session, at GMT0400, the pair is trading at 1.3229, with the EUR trading 0.02% lower from yesterday’s close.

The pair is expected to find support at 1.3188, and a fall through could take it to the next support level of 1.3146. The pair is expected to find its first resistance at 1.3282, and a rise through could take it to the next resistance level of 1.3335.

Trading trends in the pair today are expected to be determined by the release of Euro-zone industrial new orders and Purchasing Manager Index in the Euro-zone, Germany and France.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.