For the 24 hours to 23:00 GMT, GBP fell 0.71% against the USD and closed at 1.5666, after minutes from the Bank of England’s Monetary Policy Committee revealed that members Adam Posen and David Miles pushed for a £75 billion increase in the central bank’s quantitative-easing program.

The minutes of the Bank of England (BoE) monetary policy meeting showed that BoE lifted its asset purchase programme by £50.0 billion in February, through a split vote as two members called for larger stimulus. However, the policy makers were unanimous on maintaining the benchmark interest rate at the record low of 0.5%.

In the Asian session, at GMT0400, the pair is trading at 1.5670, with the GBP trading 0.03% higher from yesterday’s close.

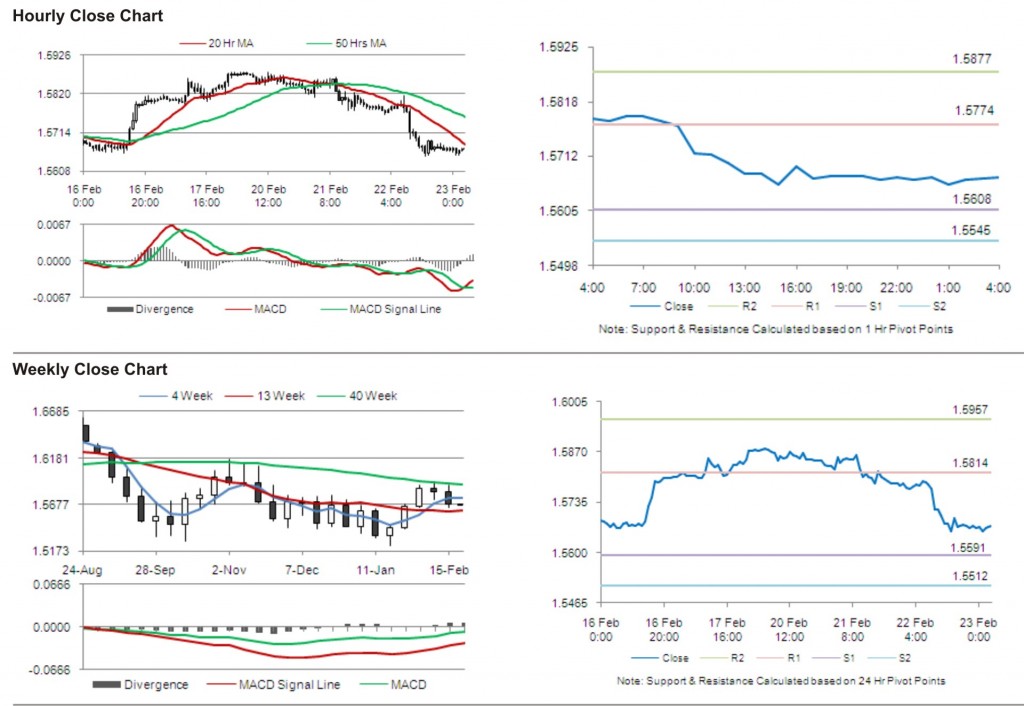

The pair is expected to find support at 1.5608, and a fall through could take it to the next support level of 1.5545. The pair is expected to find its first resistance at 1.5774, and a rise through could take it to the next resistance level of 1.5877.

Trading trends in the pair today are expected to be determined by the release of BBA loans for house purchase and CBI trends total orders in the UK.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.