For the 24 hours to 23:00 GMT, EUR rose 0.45% against the USD and closed at 1.3461, on optimism over the European Central Bank’s (ECB) allotment of three-year loans to banks later today.

Additionally, EUR received support after Italy sold €3.75 billion of a new 10-year bond with the yield declining to 5.50%, compared to 6.08% at the last auction of similar-maturity debt. It also sold €2.5 billion of 2017 bonds to yield 4.19%, down from 5.39% previously.

However, during the day, EUR had come under pressure after the ECB stated that it had suspended the eligibility of Greek government bonds for use as collateral in the central bank’s funding operations. Also, it pared some of its gains on reports that Ireland is to hold a referendum on the new European Union fiscal treaty.

On the economic front, the Economic Sentiment Index in the Euro-zone rose to 94.4 in February, while the Industrial Confidence Index rose to -5.8 in February. Additionally, confidence in the construction sector improved to a reading of -24.5 in February, while the Consumer Confidence Index stood at a reading of -20.3 in February.

In Germany, the GfK Group reported that Consumer Confidence Index is forecasted to rise to a reading of 6.0 in March. The Consumer Price Index in Germany rose 0.7% (MoM) in February.

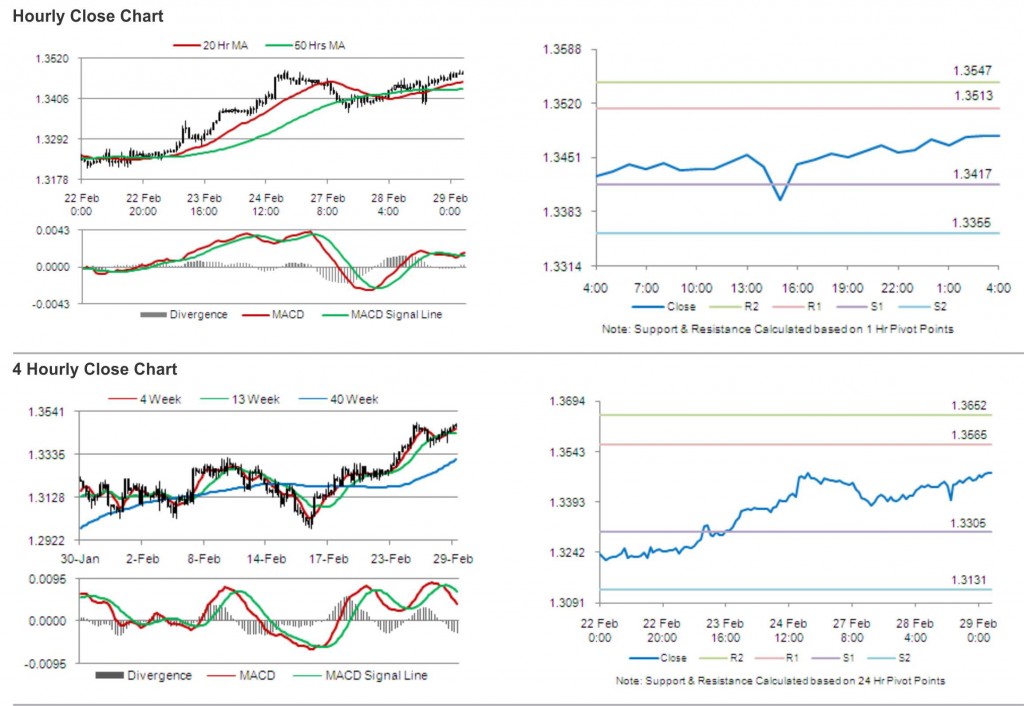

In the Asian session, at GMT0400, the pair is trading at 1.3478, with the EUR trading 0.13% higher from yesterday’s close.

The pair is expected to find support at 1.3417, and a fall through could take it to the next support level of 1.3355. The pair is expected to find its first resistance at 1.3513, and a rise through could take it to the next resistance level of 1.3547.

Trading trends in the pair today are expected to be determined by the release of Euro-zone Consumer Price Index and German Unemployment report.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.