For the 24 hours to 23:00 GMT, GBP rose 0.45% against the USD and closed at 1.5900.

The Confederation of British Industry (CBI) in its Distributive Trades Survey reported that the retail sales balance in the UK climbed to -2.0 in February, marking the highest level in eight months.

Separately, Bank of England’s (BoE) Deputy Governor, Paul Tucker, has indicated that policy makers must be ready to “gradually” withdraw stimulus as and when the UK economy strengthens.

Meanwhile, Bank of England policymaker, Ben Broadbent, stated that the Euro-zone debt crisis still poses the biggest single risk to the UK economy even though important decisions would see it gradually improve over time.

In the Asian session, at GMT0400, the pair is trading at 1.5930, with the GBP trading 0.19% higher from yesterday’s close, after the Gfk consumer confidence index remained unchanged at -29.0 in February, the highest reading since June.

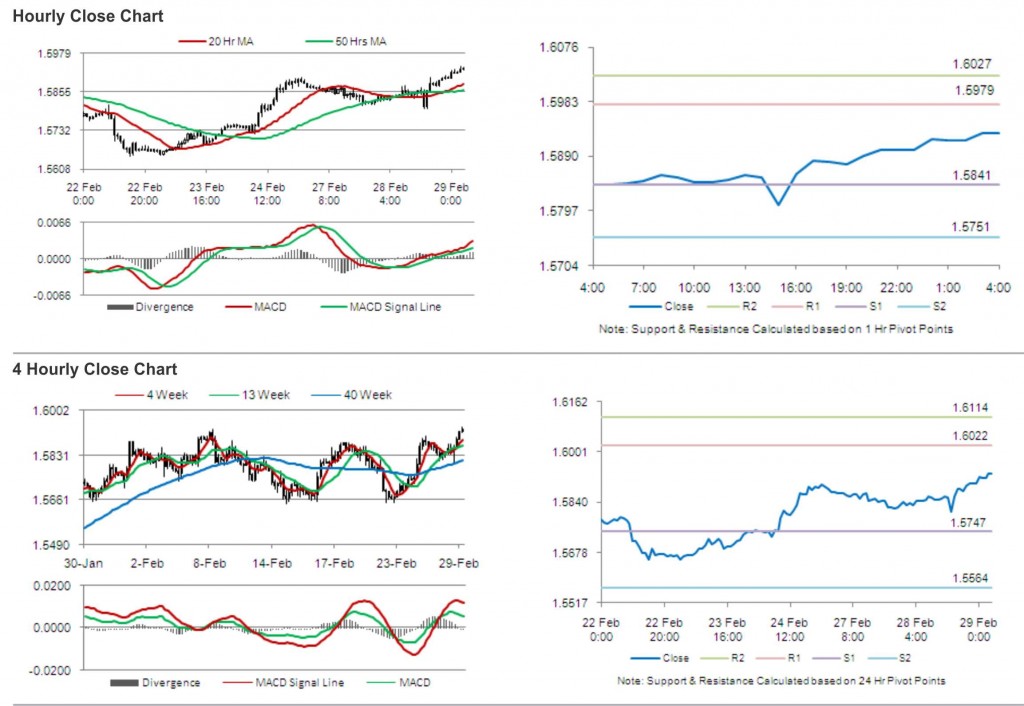

The pair is expected to find support at 1.5841, and a fall through could take it to the next support level of 1.5751. The pair is expected to find its first resistance at 1.5979, and a rise through could take it to the next resistance level of 1.6027.

The pair is expected to trade on the cues from the release of mortgage approvals and net consumer credit in the UK, later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.